1985, 1998, 2023, 2030, it doesn’t matter what year it is.

Until the fundamentals of property change, I will remain ALL-IN!

The when doesn’t matter, there’s always going to be someone, somewhere reporting on the dire state of the rental market, telling me that the BTL sector is on its knees, reduced to curdled dog turd by tightening legislation and an increasingly tough economy. Like, right now, whatever year it may be. Google it, you’ll find an article. The internet is great.

“It’s not worth it anymore, the numbers don’t add up”

Oh man, again?

Well in that case, yet again, I ain’t selling shit. Especially now.

Not only am I holding tight, but for the first time in years I feel inspired to lock eyes with the dealer and double-down on my conviction.

HIT ME!

I’m not getting shaken out of the market because people have lost their freaking minds and don’t understand economics. No Goddamn way!

Man, I feel invigorated. I could do 4 Jumping Jacks and eat an unpeeled avocado whole right now. Mind you, I’ve just eaten, so I won’t. I’ll stick to typing.

This is why I personally believe property (and landlording) is the best place for me to store my cheese, whenever… yesterday, today, and tomorrow.

Property is an appreciating asset!

We get so caught up on the monthly cash-flow that we forget property is an appreciating asset and cash is inflationary garbage!

Funny, innit? That the best feature of property as an asset class barely gets any airtime, particularly by emotional landlords seeking refuge on the Property Tribes forums because their portfolio is a ticking time-bomb, or by reputable *cough* property journalists when they’re ripping the market a new one during any remote sign of distress. It really is no wonder the fear spreads like a virus.

Understandable, of course, because the new strain of “get rich quick” landlords won’t learn the value of appreciating assets during their rent-to-rent retreat hosted by their favourite Insta property guru, BECAUSE IT’S NOT RELEVANT WHEN YOU’RE LEARNING HOW TO INVEST IN FUCK-ALL.

To all my rent-to-rent foes out there, class is in session! Admittedly, you were never meant to be the focal point of this blog post, and you’re still not, but as an indirect consequence, I’m going to partly explain why you are not a “property investor”, but rather, lamb to the slaughter.

*adjusts loose tie*

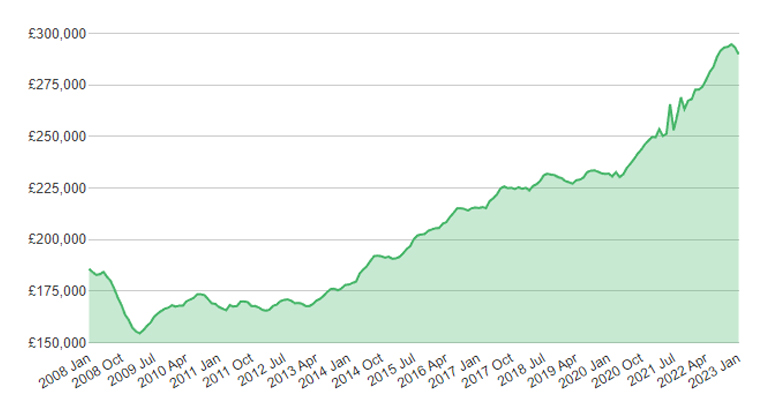

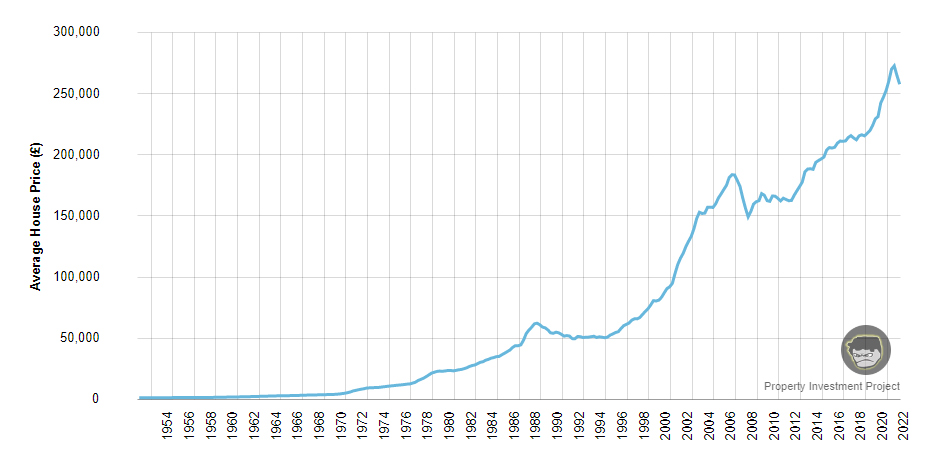

Average UK house price between 2008 – 2023

The chart below shows how property has increased in value over 15 years.

Fabulous, isn’t she?

Source: propertydata.co.uk

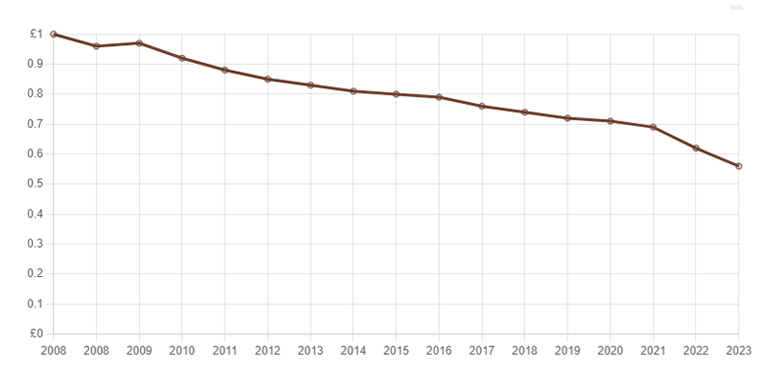

The value of 1 GBP between 2008 – 2023

The chart below shows how £1 has lost value over the same 15 year period.

Ghastly as a buck-toothed hemorrhoid, isn’t he?

Source: officialdata.org

The simplest way to explain it is (with abstract and fictional numbers):

- £1 in 2008 will buy you 3 cans of coke, in 2023 the same £1 will buy you 2 cans of coke.

- 1 property in 2008 is worth 20,000 cans of coke, in 2023 that same property is worth 30,000 cans of coke.

- Capitalism is killed

- Inflation is permanently taken out of the monetary system

- Supply outstrips demand (for this to happen, the government need to break a habit of a lifetime by building enough homes. Hahah!)

- There’s a fundamental change in human behaviour which leads us to no longer requiring houses

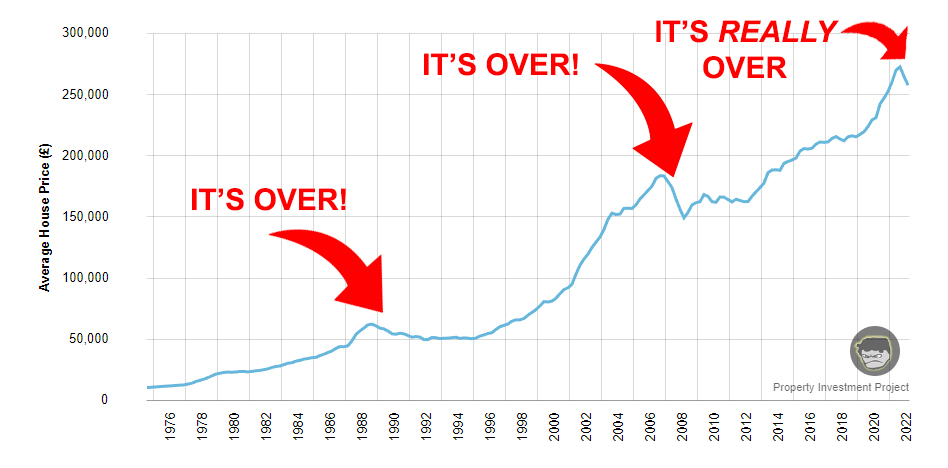

- 2008 – The party’s over for buy to let investors

- 2023 – Why the sums no longer add up for small-time landlords

Property holds value better than cash.

I’ve said it before and I’ll say it again, I find it odd when people get scared to invest in property and/or make the financial decision to sell off their hard assets [when they don’t need to] during a recession and/or inflationary environment only to hoard cash, which many are right now.

I understand *why* people do it, because holding cash seems like a safe-play, but the data convincingly indicates that it’s a pitiful method of preserving and generating wealth. Basically, if I’m going to trade an appreciating asset to sit on cash, I may as well also trade my nut sacks for magic beans.

I also frequently come across the following argument in various pea-brained forms:

If you buy a rental property that gives you a 4% ROI, you may as well stick it in a high-yielding savings account that offers 4%, because it’s a whole lot less hassle for the same return.

Oh, come on! Are we really doing this?

We are.

In short, no, my good sir, we may as well not do that, because one of those will increase in value over time, the other will freefall out of your arse like last week’s curry.

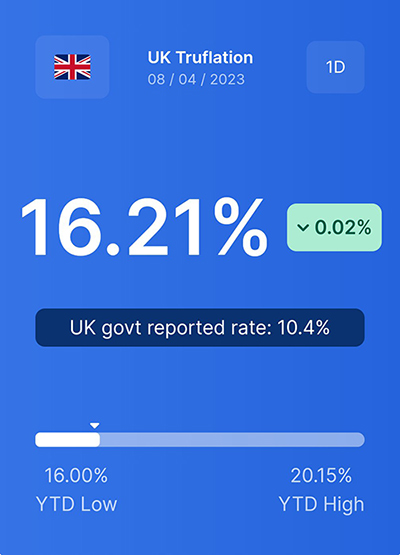

The “official UK inflation rate” (by that, I mean the massaged rate the government wheels out) at the time of writing this blog post is 10’ish per cent, so that means my money would have eroded by 6% in buying power over the course of a year while being held hostage in that lousy-ass savings account.

If you think that’s painful, then the true inflation rate will floor you like a rogue boomerang to the noggin, because it’s a stonking 16%. BOSH!

From personal experience, I know my bills have certainly gone up closer to 16%, and it’s no way near as piffling as 10%.

Source: truflation.com – a wonderfully scary and eye-opening website that more reliably tracks inflation by taking into account every day products and services we actually purchase. It’s everything they don’t want you to see.

The whole point of “storing” money in property is to protect and preserve our wealth against eroding fiat currencies (e.g. British Pound), isn’t it?

I’m not paying through the arse for a pile of bricks, jumping through bullshit regulatory hoops, and effectively being a glorified babysitter and concierge service rolled into one, for a -6% return (adjusted for the massaged inflation rate). That would be mental.

I always remind myself: Property Vs GBP – that is why we are in the game. We want property to outperform our local currency, which it consistently does, and the reality is, it’s really a one horse race. Why? Consider how much easier it is to Print money Vs Build houses.

To clarify, I invest in property to outperform GBP and inflation in the long-term, not short timeframes. There will be short periods when even property gets savaged by inflation (but it pales in comparison to the grooming GBP gets).

I’m not scared of investing my own money into property

When did it become mandatory or even necessary for rental income to cover all costs?

I always see landlords armed with rage and pitchforks when interest rates increase, because it means they’re forced to dip their grubby little mitts into their pocket to cover short-falls.

I did that mother-bitch for several years. SEVERAL YEARS! And I would do it again.

Yes, it hurt. But not for one moment did I feel victimised or like I was throwing money down the drain.

I felt like I was contributing towards a savings account, only with significantly better returns down the road. I guess the process is easier to stomach when you understand that cash locked into property (even without renting it out) is likely going to do a better job fighting inflation compared to leaving it dormant in a savings account.

More to the point, if you get wounded by a bullet in the form of a £15k net loss over the span of 5 years while your property increases in value by £25k, are you really bleeding?

In my previous blog post, I wrote about a commercial property that was passed down to me by my dad. Initially, the lovable bone-head wanted to liquidate the asset and disperse the cash. I shut that idea down real quick, because I know the value will be better preserved right where it is.

I firmly believe that ownership of the right property along with sensible risk management (neither can be understated) is one of the most resilient investments anyone can make.

Will property prices keep going up?

I don’t know, you tell me.

Do you think this trend is finally broken?

Source: Nationwide House Price Index

It’s really simple for me: I either believe property prices will do something it has never done before, or it will continue doing what it’s always done.

If I believe in the former, I should consider sobbing into your bosoms and selling.

Otherwise, it would be wise of me to hold and/or buy more.

As I’ve said before, it’s really difficult for me to imagine that property has hit its ceiling and lose value against our decaying GBP currency, unless there’s a major societal and/or economical shift, such as:

I’m not convinced we’re close to any of those possibilities, which is why all the panic-driven noise that inevitably gets louder during turmoil gets flushed down my bog, pronto.

Alas, I’ve noticed that many landlords stop and get distracted by the noise (i.e. regulatory changes), like the people that slow down to catch a glimpse of a car crash on the motorway, like they’re about to witness the Second Coming of Christ.

I stopped listening to the racket after I heroically (yes, heroically) crawled through the 07/08 property crash on my blooded knees, because in hindsight it’s clear as day how inconsequential all of it really was, which is why I’m currently eager to get my dosh out of the bank and into property (and Bitcoin/crypto), despite the media reporting a stampede towards the exit door.

On a side note, it’s impossible to really know how many landlords there are entering and exiting the market, so any reported numbers can only be inaccurate and based on anecdotal evidence. There are too many underground landlords that move within the sector; many of whom won’t get BTL mortgages or declare earnings, so they’ll be completely off-grid, like a fart in a windstorm. So even when it’s reported there is a “landlord exodus” (something I’ve heard several times during my reign), I’d wager a hefty bet on the fact there us no real evidence to support the claim.

I know, I know, I’ve set myself up for some glorious and chaotic pushback. What about S24, proposed changes to the minimum EPC rating, the prospect of S21 being abolished?!?!?

*sticks fingers in ears* LALALALAL LAAAAL LALA

Bro, I’ve considered it all, my numbers still stack up. My fear is you haven’t properly thought this through.

TheTimes.co.uk:

Can you see what they are doing?

Evidently, the BTL market behaves like a practising Buddhist or a cat, because it’s either continuously reincarnating or it’s got multiple lives. Incredible.

You might be unsurprised to learn that neither article mentions how much less valuable £1 has become over time, even though it’s the most important variable of the equation. Journalists love to beat the property/rental market with the ugly-stick with one-dimensional ‘in the moment‘ viewpoints, ignoring long-term performance and the weakening currency it’s being benchmarked against. That’s sloppy at best, and actually makes little no sense.

£450billion was printed out of thin air during the pandemic alone, let that sink in.

So it blows my puny little mind that people continue to get distracted and unnecessarily force themselves out of the market.

Being a landlord (a real landlord with skin in the game, that is) is not just about rental income, it’s also about the asset that comes with the job.

The “job” part was obviously a joke. We all seriously need to get real jobs.

Of course, BTL is like any other business, in the sense that it will fall victim during tough times if debt becomes unmanageable due to poor risk management. That’s business. None of this is sustainable if you’re up to your eyeballs in syphilis and expensive debt. For example, Section 24 is not killing off landlords with low leverage.

Finally, I truly appreciate everyone’s circumstances are different, so I’m not telling anyone else what they should be doing with their finances, I’m just saying, there’s never not been a reason to get shaken out of the market.

Moreover, there’s a reason why the biggest transfer of wealth occurs during recessions. it’s because dumb money panic-sells to smart money.

Dealer, HIT ME!!

Stay strong, my friend.

Landlord out xoxo

Disclaimer: I'm just a landlord blogger; I'm 100% not qualified to give legal or financial advice. I'm a doofus. Any information I share is my unqualified opinion, and should never be construed as professional legal or financial advice. You should definitely get advice from a qualified professional for any legal or financial matters. For more information, please read my full disclaimer.

Landlord Products / Services

Landlord Products / Services

@Ebs

I buy all my crypto from Coinbase and Crypto.com App.