First and foremost, my sincere condolences.

There’s nothing funny about owning a property that’s sinking into the ground and as wonky as a 3-legged donkey. I’m sure there’s even less amusement in trying to flog the damn thing.

However, despite the dishevelled money-pit you see before you, hopefully you’ll take solace – albeit a puny amount – in the fact that selling a property with subsidence is entirely possible, and often, it really doesn’t have to be all that difficult. The reality is, the property market is familiar with properties plagued with subsidence – they’re frequently being sold (and purchased).

So, in this blog post, I’m going to run through one or two of the most obvious and not-so-obvious options available to you when it comes to selling a house with subsidence, along with a few other crucial points to consider…

What you should consider before selling your property with subsidence

Step 1) You’ll need to disclose subsidence when selling your home

No, don’t worry, you’re not a totally ghastly person for considering it! Alas, you’re probably only human if you’ve thought about keeping it a secret.

Jokes aside! If your home suffers from subsidence, or has a history of it (even if it’s been resolved), you must declare it to the estate agent and the buyer, otherwise you run the risk of being sued for misrepresentation. Honesty is the best policy, apparently *shrugs shoulders* Don’t shoot the messenger.

It’s also worth bearing in mind that when a buyer instructs a structural surveyor on their behalf (which is standard practise, and a prerequisite enforced by most mortgage lenders), they’ll probably pick up on the fact that you’re trying to sell a dud. Or at least, they should.

Yes, so that could be a highly embarrassing situation if you don’t disclose the dirt.

Step 2) Get a structural survey

A RICS qualified Structural Engineer will be able to conduct a structural survey of the property to assess the situation, so you can properly inform the agent and buyer of the situation.

If the property has a history of subsidence, the surveyor will be able to determine if continued movement is un/likely, and if any improvements need to be made.

I recently spoke to a helpful chap that buys defected properties for a living, and this is what he had to say:

It would always be advisable to speak with a structural engineer in the first instance. Before you tackle any problem, you need to understand what you are dealing with. A structural engineer will be able to identify the cause of the movement and how to remedy the situation. Once you have this information you will be in a position to get quotes from builders and from there you will be in a position to make a decision to either make the relevant repairs, or sell it as it is. If you choose to sell it as it is, at least you will have a greater understanding of the work and cost involved when negotiating an onward sale.

Step 3) Will your home insurance cover the cost to repair subsidence?

This point is self-explanatory: check if your insurance policy covers subsidence damage. Most standard policies don’t, but some do. Worth checking either way.

Step 4) Decide whether to fix the problem first, or market the property with subsidence [at a discounted price]

After you’ve taken into considering the financial cost and emotional stress of repairing your property, you’ll need to decide whether you want to sell the property as it is (i.e. a lop-sided sinking ship) or invest in restoration.

There’s obviously no need to tell you that both options have their obvious pros and cons.

Hopefully you’re not totally deluded, so you already understand that you should be prepared to take a serious hit on your finances either way. You either fork out for the repairs, or you take a serious hit on the asking price when you put it to market (around 20%. Ouch!).

According to this article on checkatrade.com, the average cost to fix subsidence is £12,500. But that’s just the average cost, each case will depend on the severity (or lack thereof, if you’re lucky).

Something else to bear in mind is that properties with subsidence will likely need to be purchased by cash buyers as mortgage lenders are unlikely to touch them with a barge pole as they are generally uninsurable. Needless to say, your audience becomes considerably tiny if you need to target cash buyers, which can considerably impact the efficiency of a sale.

How to sell a house with subsidence

Option 1) Use a traditional estate agency (the obvious)

Advantages:

- Most likely to achieve better sale-price

- Estate agents are regulated

Disadvantages:

- Potentially very slow process

- Limited interest

- Estate agency fees/commission

Yup, it’s entirely possible (and normal) to go down the traditional route of selling your property via your local high-street agent. Most experienced agents will have experience in selling properties with subsidence, because as said, it really isn’t that unusual.

Common sense prevails, so you shouldn’t be surprised by potentially severe delays, an extreme shortage of interest, and a gigantic sledgehammer to the asking price. Or, you could just get lucky. Some agents may even have direct contact to property developers that are constantly on the hunt for defected properties, but in my opinion, if you’re interested in this route, you’re better off using option 2 (below).

Either way, I recommend going into battle with the worst case scenario (and some) in mind, that way at least you won’t be disappointed.

Option 2) Use a “We buy any house” company (the wildcard)

Advantages:

- Quick cash sale

- No fuss

- All fees are usually included with the sale price, including legal

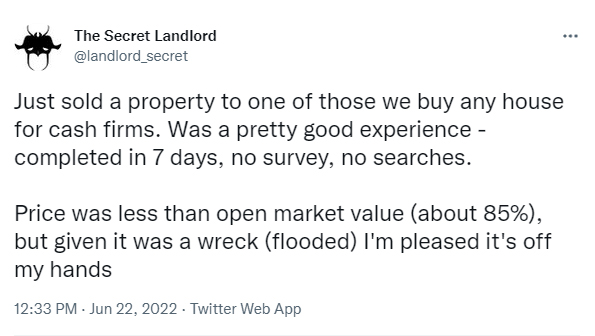

- To illustrate my point, here’s a Tweet I saw my timeline, by someone that goes by the alias @landlord_secret):

No, he didn’t sell a property with subsidence, but he did sell a “difficult” property no less, so you get my point.

Disadvantages:

- You’ll have to sell below market value

- Unregulated industry (although, the most reputable companies in this sector are members of redress schemes)

This is a bit of a wildcard, but it’s something you should definitely mull over, or at least be aware of, because it could be the saving grace you’ve been looking for, especially if you’re itching to get rid of your toppling palace and fancy an effortless and quick sale.

Property cash buying companies, also referred to as “We buy any house” companies, take a keen interest in this particular niche of the property market. As in, they drool over defected properties and love scooping them up at bargain prices.

Long story short, many (but not all) property cash buying companies will happily chew your arm off if you’re flogging a property with subsidence. But once again, I hope common sense prevails, and doesn’t allow you to forget that there is no such thing as a free lunch, especially in this industry.

While using a property cash buying company can be extremely quick and stress-free (i.e. it’s possible to complete a sale within 7 days and have money in the bank just as swiftly), it will cost you. Most of these companies will offer anywhere between 75%-85% of the market value, and that can be one tough pill to swallow. But with that said, they’re extremely popular among “desperate sellers”, and you might be surprised to learn that there isn’t a shortage of positive reviews for these services. They certainly must be doing something right.

An example of reputable Cash Buyer Company…

I can’t personally recommend a cash buyer company from personal experience, but if I were to use one, MyHomebuyers.co.uk would be my first port of call (my reason for that is explained right over here, in my MyHomebuyers review). In any case, here’s a fine example of what you can expect from a reputable company offering a cash buying service…

| Service | Rating | Features | Offers (up to) | |

|---|---|---|---|---|

My Homebuyers | Rating TrustPilot Reviews | Features

| Offers (up to) 80-85%of Market Value | Get cash offer |

I don’t know your personal circumstances, so it’s down to you to decide how much a quick and easy sale is worth to you.

If you’re interested in the long story, here’s some further reading:

- my full guide on “We Buy Any House” companies – in there, you’ll also find a list of the top-rated property cash buying companies I’ve hand-picked, which you can get quotes/cash offers from (no obligations).

- Q&A with a professional house buying company – you’ll be able to get a deeper understanding of how their process works when it comes to buying a house with subsidence.

Before I sign out, I want to quickly touch on a previous point I made, where I alluded to the fact that I would rather use a cash buyer company over using a property developer. Reason being, property developers will use similar margins, but they’re likely to get you over the finish line at a slower pace.

Once again, sorry to hear about your wonky home. But I wish you the best of luck.

Feel free to drop a comment, whether you have any questions or want to simply share your story…

Disclaimer: I'm just a landlord blogger; I'm 100% not qualified to give legal or financial advice. I'm a doofus. Any information I share is my unqualified opinion, and should never be construed as professional legal or financial advice. You should definitely get advice from a qualified professional for any legal or financial matters. For more information, please read my full disclaimer.

Landlord Products / Services

Landlord Products / Services