I’ll spare you from being presented with a sugar-coating a flaming turd – there’s absolutely no point. If you’ve landed on this page after searching for solutions on how to sell a leasehold property with a short lease, you already know exactly what’s going on – it’s a dumpster fire.

With the cost-of-living continuing to catapult into orbit, leasehold properties are getting absolutely battered. Their values are dumping faster than any other type of property, especially in London.

There’s a very small market for properties that come with service charges that exceed the cost of a mortgage.

There’s an even smaller market when the lease term drops below 80 years (the widely accepted definition for a “short lease”, apparently, for reasons I’ll address).

The reality is, many people can’t jump off the leasehold ship fast enough, whether by choice or force. Some are even willing to take a loss just to stop the bleeding.

Needless to say, I’m not here to tell anyone what they should do. But for those looking to sell a property with a short (or long) lease, I can share a solution – one that’s proven to be highly effective, even though it’s not the prettiest option…

Why are Leasehold Properties Difficult to Sell (Particularly Ones with Short Leases Remaining)?

In the current economic environment, where inflation is rampant and salaries have failed to keep pace, people are struggling. I don’t need to tell you, I’m sure.

We are in a period where leasehold service charges, like all other utility bills, continue to rise. The costs have reached a point where leaseholds are becoming financially untenable for more and more homeowners. As a result, more people want to exit, and even fewer want to enter.

To add insult to injury, homeowners with short leaseholds face an even greater cluster-fuck to contend with; a property with less than 80 years remaining on its lease is classified as a short leasehold, and such properties can lose 10 – 20% of their value.

When a lease is running out, the property becomes less valuable because the homeowner has fewer years of ownership left. But if the lease is extended, the property’s value goes up again. Yay!

So what’s the problem?

This increase in value is called “marriage value“. By law, if a homeowner wants to extend their lease and the remaining time is less than 80 years, they must pay the landlord 50% of this increase in value as compensation.

Here’s a simple example with numbers:

- Imagine you own a leasehold property that is currently worth £200,000 because the lease is short (under 80 years).

- If you extend the lease, the property’s value increases to £240,000.

- The marriage value is the difference between these two amounts: £240,000 – £200,000 = £40,000 (marriage value).

- By law, you must pay the landlord 50% of this marriage value as compensation: 50% of £40,000 = £20,000.

So, in this case, you would need to pay the landlord £20,000 to extend your lease if it has less than 80 years remaining, and that doesn’t include additional costs such as legal fees and other associated expenses (which by it self can be eye-watering).

Ouch!

The Solution? Property Cash Buying Companies That Purchase Flats with Short Leaseholds

You might have already considered this option, hoping it wouldn’t be the solution presented here, or a solution you may actually have to take seriously.

Unfortunately, the reality is, selling a flat with a short lease to a property cash-buying company (aka “we buy any house” companies) for below market value – typically around 75% to 85% – is the fastest, easiest, and most effective option. That’s precisely why demand for these services is growing, with new property cash buyer companies popping up every day.

I know, I know! Believe me, I know. Whether you want to accept it or not, this is an option – and an effective one at that.

Property cash buyer companies specialise in buying “difficult” properties, including flats with short leases, that are proving to be a bloody nightmare to get off the car lot.

I mean, hopefully, we can all agree that the offer on the table is easy on the eyes…

- Cash offer with in 48 hours (no obligations)

- Complete sale in as little as 7 days

- No fees to pay, they cover all costs (including legal)

- Any property, any condition considered

The perks are obviously great, but are they enough to outweigh the 20–25% discount you’ll have to take on the sale?

I know it’s not ideal, but neither is the situation.

And yes, the cash buyer market can be is highly predatory. There’s no shortage of rogue operators itching to exploit your situation. But the good news? There are also reputable companies out there genuinely working to level the playing field. That’s who you want to work with!

If you’re interested, I’ve put together a full guide on cash buyer property companies, including red flags to watch out for and which ones to avoid like the plague.

Property cash buyer companies aren’t regulated – nor is the industry – meaning consumers have no formal protection when selling to one of these companies.

That’s why it’s crucial to choose a reputable company that is a member of the National Association of Property Buyers (NAPB). NAPB requires all its members to register with The Property Ombudsman (TPOS), ensuring homeowners have access to independent redress in the event of a dispute.

While every property cash buyer will low-ball you (because that’s their business and how they make money), and some offers are so disgusting they might make you keel over like a sack of puds. But that said, there are definitely reputable companies out there providing a transparent, honest, and high-quality service.

If you’re considering this route and understand the trade-offs, I can’t stress enough the importance of choosing a trustworthy company to assist you.

I’ve been covering the property cash buyer market for years and have spent a significant amount of time researching the sector. I’m not claiming to know it all, but I’ve done enough due diligence to confidently partner with companies I believe belong in the reputable bracket.

| Service | Rating | Features | Offers (up to) | |

|---|---|---|---|---|

Home House Buyers | Rating Reviews.co.uk | Features

| Offers (up to) 80-85%of Market Value | Get cash offer |

House Buy Fast | Rating Reviews.co.uk | Features

| Offers (up to) 85%of Market Value | Get cash offer |

Property Solvers | Rating TrustPilot Reviews | Features

| Offers (up to) 75%of Market Value | Get cash offer |

Please note, I try my best to keep the information of each service up-to-date, but you should read the T&C's from their website for the most up-to-date and accurate information.

To be clear, I’m not saying these are the only trustworthy cash buyer companies out in the wild. But these are the ones I’ve personally researched and partnered with – some even after initially featuring them in my recommendations, which is amazing! That said, I implore you to conduct your own due diligence.

Cash Buyer Companies Are Scammers! So Why Should I Use Them to Sell My Flat?

Yup, a lot of them are scammers – 100% true.

However, if your definition of a “scammer” is simply a company making no-obligation cash offers that are significantly lower than expectations, I have to push back. That’s not what a scammer is.

The real scammers use far more deceptive tactics: emotional blackmail, false promises, misleading valuations, and contracts packed with hidden clauses. In short, they operate with zero integrity and transparency.

So, why would anyone use them then?

As mentioned, they are without doubt, effective.

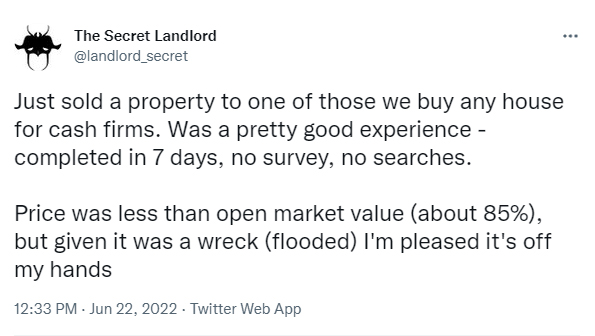

Case in point, here’s a Tweet I randomly bumped into on my timeline, by someone that goes by the alias @landlord_secret:

But beyond speed, there’s another factor to consider – the cost of keeping a property on the market for months in a declining market.

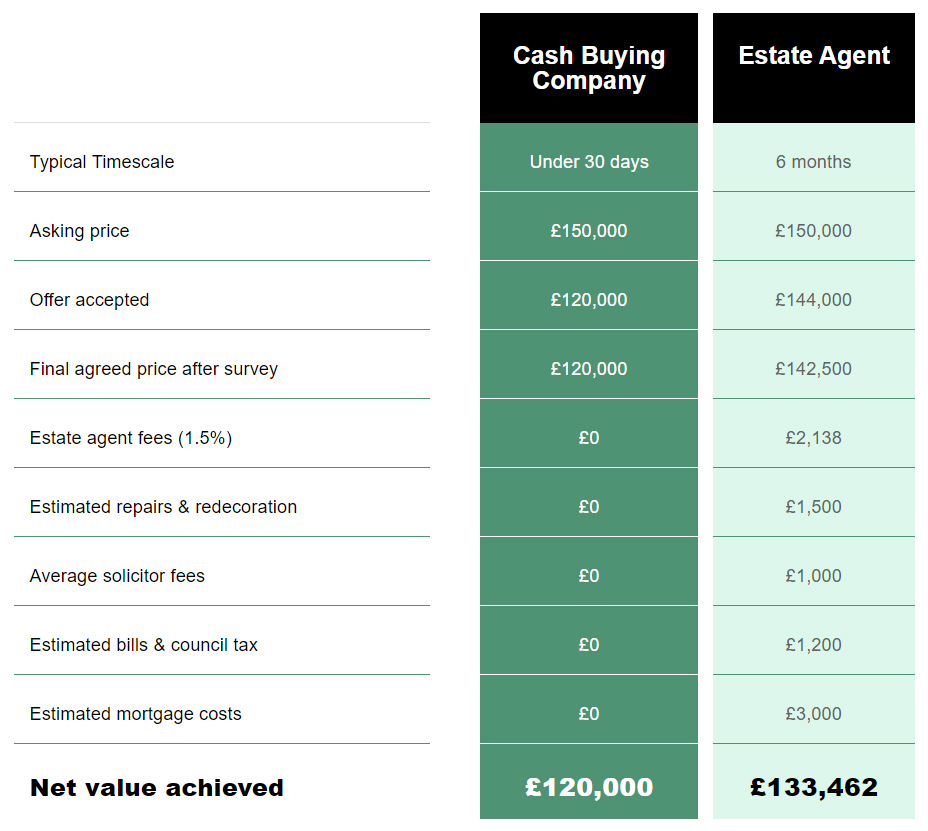

Most cash-buying companies display an enticing comparison table on their homepage, pitting their service against traditional estate agents. Unsurprisingly, it paints a rosy picture in their favour.

It usually looks something like this:

How accurate is it? While biased, it does highlight one undeniable truth: selling on the open market can be a slow, costly process – something many sellers overlook. Time is money, and cash buyers save sellers a lot of time.

- January 2024: A leasehold flat is valued at £100K, and a cash buyer offers £85K.

- The seller rejects it, opting for the open market instead, hoping to get the full £100K.

- Fast forward 12 months, January 2025. The property is still unsold, interest has dwindled, and now it’s worth £92K. A cash buyer might now offer £80K.

You get the idea.

So, should you use a cash buyer company to sell your leasehold flat?

That’s not for me little old me to decide for you. I don’t know you, and I don’t know your circumstances.

My goal isn’t to push this option on anyone. I appreciate both the pros and cons of using a cash buyer company and fully understand that it’s not the right fit for most sellers. However, I also recognise why it has been the perfect solution for thousands of sellers up and down the country.

The purpose of this blog post is three pronged:

- To make people aware of a highly effective solution for those stuck in the leasehold trap.

- To emphasize the importance of using a reputable company if this route is an option for you.

- To give some well-earned recognition to trusted partners in the space.

Hopefully I accomplished what I set out to do.

As mentioned, if you want a much more thorough and detailed breakdown, I highly recommend my guide to cash buyer property companies.

Disclaimer: I'm just a landlord blogger; I'm 100% not qualified to give legal or financial advice. I'm a doofus. Any information I share is my unqualified opinion, and should never be construed as professional legal or financial advice. You should definitely get advice from a qualified professional for any legal or financial matters. For more information, please read my full disclaimer.

Landlord Products / Services

Landlord Products / Services