Full disclosure: there’s a lot to unpack here, but it might be worth the journey (no promises!) if you want a genuinely unique and awesome service to sell an empty property!

So, today, I want to circle back to flyp.co, a house-selling company that I’ve already introduced as a shiny new object that has positioned itself in between the seller and local estate agents, offering a unique set of services that ultimately helps homes sell quicker than average for the most amount of money.

Their service has been praised by the likes of theadvisory.co.uk (apparently that’s a big deal. A significantly bigger deal than me covering it in my little virtual sanctuary *grumble*), and all I can say is that I totally get it, and hopefully by the end of this post you will also.

However, one of my biggest gripes with flyp – which I made absolutely no attempt of underplaying in my flyp.co service review – is their shockingly criminal attempt at explaining how their services actually works on their own fancy-pants website. One word, sloppy!

That’s precisely why I felt forced to do a deep dive on their multi-agency sales service (which is prime for most average people looking to sell their home), and now, in the same vein, properly explain another arm of their service, one that’s been highly optimised for selling empty properties, which provides the best of all worlds to sellers: earn rental income WHILE selling!

As an onlooker, I’m actually convinced flyp’s service is currently the best option for anyone looking to sell an empty property. For example, vacant rental properties, properties in probate etc. To be honest, it doesn’t matter why you have an empty vessel weighing your neck down to the pavement, the point is flyp’s unique service is the fix, and I’m here to explain how and why (least of all because they certainly don’t)…

Why flyp (when selling an empty property)?

- Fully managed transformation, rental and sales service!

- Multi-layered sales approach, which can include the following steps:

- Transformation: identify impactful opportunities where the property can be improved to add real value. Fully funded by flyp (up to £150,000).

- Rental: short-let property while it’s being marketed for sale

- Sales: “multi-agency” sales approach, to help sell ASAP

- Earn revenue while your property is on the market for sale

- Achieve the highest sale price

How it works step-by-step

Admittedly, I really initially struggled to wrap my noggin around flyp’s service, even after the details were spoon-fed to me like a toddler. It’s just, their unique multi-layered approach was nothing I had come across before. After their first few attempts [of breaking it down], I literally said to them, “explain it to me like I’m six years old. No, wait, better make it four!”

We got there in the end, so now I’ll do my best to explain it to you…

Step 1: Book an assessment

Book a free, no obligation appraisal. This will include a virtual in-depth assessment on the current and potential value of your property.

Step 2: Transformation analysis

flyp will determine if the property is “sale ready”, or if and where a house can be improved to add value before going to market (this can include hefty renovations and interior design upgrades).

flyp pay for the entire transformation (up to £150,000) and then recoup their investment from any rental income generated (if applicable) and/or the sale proceeds. But ultimately, the idea is that the seller ends up with the majority share and makes more money from the sale compared to pre-transformation (this is critical to understand).

Step 3: Let’s go to market (with a multi-agency sales approach)

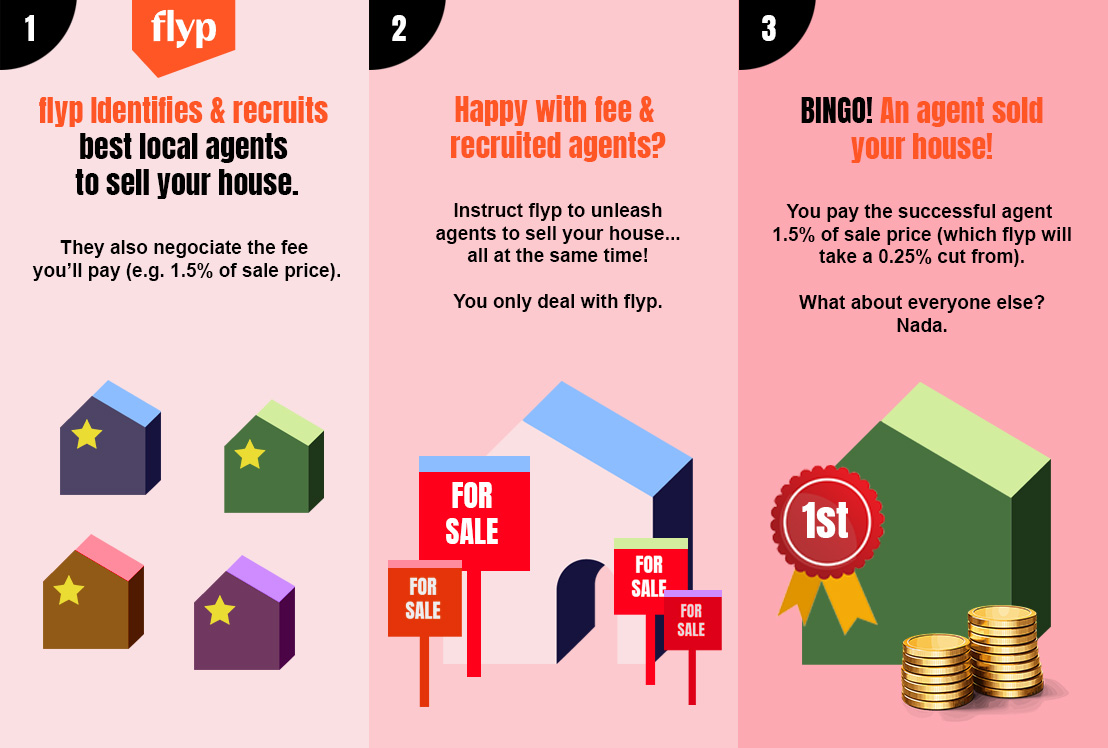

Once flyp officially stamps your property with the “sale ready” seal of approval, they will deploy a multi-agency sales strategy to sell your house.

In short, that means they will get the best local agents in your area to market your property at the same time (instead of the typical one local agent), maximising exposure and increasing the speed of sale.

If you want to know more and how it’s all possible, here’s a more in-depth and waffly explanation of how multi-agency sales work.

Alternatively, here’s the toddler version…

Step 4: Let’s see if there’s opportunity to make money while it’s on the market

Once the property is ready for market – and if a buyer hasn’t been found – flyp will then host short-term rentals in the property, so this way you can generate rental income while it’s vacant and being marketed for sale.

The ‘guests’ agree to flexible rental tenancies (1-3 months) through a license agreement, meaning they do not have any tenancy rights. Longer agreements can also be arranged, as the license structure applies regardless of the length of stay. The key point is that no tenancy rights are given. Ever!

Occupants can be vacated with 4 weeks’ notice, which is ideal since it can take several weeks to complete a sale once a buyer is found

flyp manages the guest viewings and ensures the property is cleaned and staged each day viewings are scheduled. According to my contact at flyp, this approach results in ‘flawless viewings‘ (their words, not mine!).

Step 5: SOLD!

Mission accomplished, and only now you cough-up the doe (coming up next, your fees explained!).

Get a free no-obligations appraisal from flyp

How much does flyp’s service cost?

This is the beauty of it (in my opinion).

Actually, the beauty is in the unique service itself, but their fee structure is also easy on the eyes.

The key point to remember is that flyp’s flexible service is designed for sellers to walk away with as much money as possible from the sale of their house… even after their fees.

Cost 1: £375 + VAT upfront fee (offset against the final fee)

flyp take an upfront fee of £375 + VAT, which is offset against the final fee. It is also guaranteed, so the fee is returned in full if they do not get at least 5 agents actively engaged on the sale.

Side note: I’ve heard through the grapevine that flyp is open to waiving this fee altogether, especially if you pile on a sob story about being strapped for cash. But you didn’t hear it from me!

Cost 2: Transformation service

If it is determined that a transformation is required, then flyp will recoup their investment from the sale by taking up to 40% of the value they’ve created (the exact amount will be confirmed with you prior any official agreements are made).

For example, let’s say your property was valued at £100,000 pre-transformation and £200,000 post-transformation.

If the property sells for £200,000, you will get £160,000 and flyp will pocket £40,000.

Points to remember

- flyp funds the entire transformation, you don’t pay a bean.

- flyp will fund up to £150,000 of transformations per property, which can include hefty renovations and interior design upgrades.

- flpy will recoup their investment by either rental income and/or the sale proceeds.

- The idea is that the seller makes more money from the sale compared to pre-transformation.

Cost 3: Rental service

If it’s been mutually agreed that it makes sense to temporarily short-let the property while it’s being sold, then the seller will be subject to management fees.

When I slipped into flyp’s DM’s and pressed them on their rental management fees, I was told there is no standard or generic rate, as each project is unique and tailored. However, their fees can definitely be determined during an appraisal. We good? Cool.

Points to remember

- After flyp’s management fees, you will make sweet passive rental income.

- flyp will manage all short-lets, including viewings, cleaning, guest management etc. It’s completely passive and hands-off for the seller.

- All guests will be contracted to flexible rental tenancies (1-3 months), so they can be vacated with 4 weeks notice.

Cost 4: Sales service

flyp will earn a commission of 25% from the sale of your property. But you won’t pay for that. That fee will come out of the commission that is owed to the agent that sells your property – so you never pay more than the agreed fee.

When flyp recruits the best local agents in your area to sell your property using a multi-agency sales strategy, they will negotiate a fee with each agent. Typically, this fee is 1.5% of the sale price, which is the standard rate for most high-street agents.

So you will pay the agreed upon fee to the agent (e.g. 1.5%) and flyp will take 25% out of it.

Points to remember

- All fees will be confirmed with you before you sign up to flyp’s service, so you know exactly what you will pay and shouldn’t incur any unexpected costs. it’s a completely transparent service.

- Flyp will manage the entire sales process; they will manage all the agents on your behalf, keeping the rascals in check. Your only point of contact will be your account manager at flyp.

- You pay nothing to flyp for selling your home, they will earn their commission directly from the estate agent that sells your property.

Your costs for using flyp summed up

- £375 + VAT upfront fee, which is guaranteed and offset against the final bill.

- If you use flyp’s transformation service, they will recoup their investment from the sale by taking up to 40% of the value they’ve created.

- If you use flyp’s short-let management service during the sale, they will create a tailored offer just for you and your property.

- The fee for selling your property will be 1% – 1.5% approx of the sale price, which gets paid to the agent that sells your property.

- Fees will be transparent and made clear upfront.

Get a free no-obligations appraisal from flyp

Limitations of flyp – when & why you may not be able to use their service!

Alas, flyp’s multi-layered sales model won’t work for every property. To be brutally blunt, you can’t polish a turd, and furthermore, no one wants to rent one either.

Basically, to benefit from flyp’s transformation and short-let service, you need to be in possession of real estate in a somewhat objectively “desirable” location, and perhaps a “hidden gem” that has plenty of potential to unlock.

In other words, this model is not a one size fits all kind of gig.

With that said, there are no hard and fast rules, and for all we know, you might be sitting on an undiscovered goldmine, so if you’re interested in seeing if and how flyp can help you, then by all means sign up for a no obligations, free appraisal. If you tell them I sent you they’ll throw in a free Tesla. No, I’m kidding! You’ll get absolutely nothing, but it would be cool if you did, and very much appreciated.

And… I’m done!

Hopefully I’ve done their service justice and made it make sense (the Lord knows it was required). Actually, truth be told, flyp have done such a spectacular job at underselling what I perceive to be an incredible service that I literally could have doodled a squiggle and explained it better than them.

Any questions, please feel free to drop a comment.

Landlord out xoxo

Full transparency disclaimer: Yup, I certainly am an affiliate partner of flyp.co! However, I don’t let that get in the way of speaking my truth. I genuinely took the time to understand how their service works, which lead me to feeling confident in giving them exposure. And to be clear, none of my affiliate partners tells me what to write (or when); they have no “sneak previews” or editorial/moderation rights – that’s the deal. They either like or lump it.

Disclaimer: I'm just a landlord blogger; I'm 100% not qualified to give legal or financial advice. I'm a doofus. Any information I share is my unqualified opinion, and should never be construed as professional legal or financial advice. You should definitely get advice from a qualified professional for any legal or financial matters. For more information, please read my full disclaimer.

Landlord Products / Services

Landlord Products / Services