Oh, is that pile of rubble of yours only generating 4.2% yield? Pah, what’s the point? Better off sticking the money in a high-interest savings account, and it’s less hassle!

How many times have you heard that nugget?

Every so often, I’m reminded of how misguided (or intentionally disingenuous) some folk are when they assess the return on investment (ROI) of a BTL property by solely calculating rental yield – that’s exactly what is happening here. It’s quite odd.

I witnessed it again recently, when someone – who isn’t particularly successful – tried to convince me it’s better to save than invest in property [because interest rates are, in many cases, competitive against rental yield today]. And as usual, the advice chipped away at another sliver of my soul, while also flipping my maternal instincts into autopilot, which is precisely why we’re here today. I can’t have you making the same miscalculation (not that you would).

Let’s discuss…

The risk is, if you take the sentiment at face value, you might palm-face yourself and curl up into a ball of depression, wondering why you put yourself through the meat grinder for no reason.

A high-interest savings account *slaps forehead* Of course, it could have been so simple!

Instead, I’m dealing with a deadbeat tenant that is pushing me closer and closer to the window ledge as each day passes, for bloody peanuts!

Fortunately, it’s a misleading and inaccurate reflection of our returns as landlords and property investors. Don’t take the bait.

When someone smugly makes the comparison, what they’re neglecting is:

- They’re making an assessment based on a very puny time frame. That’s cool if you’re strategising for a 1-3 year investment plan, but we’re not – being a BTL landlord isn’t a short-term gig.

Interest rates don’t remain high or compelling forever. What happens when interest rates take a dump – and remain low for an extended period of time?

- Property benefits from capital growth/appreciation.

Hello? What about Capital Growth?

One of the biggest advantages of owning property is that it provides both yield and potential for capital growth.

This is possible for a few reasons, but mainly:

- The dynamics of supply and demand

- Property is a tangible asset that can accrue additional value. For example, by identifying and investing in future “hotspots,” such as areas undergoing local infrastructure improvements, house prices can experience rapid appreciation. Think London Stratford post the approval of the London Olympics. BOOM!

Fiat money is backed by diddly-squat; it has no intrinsic value, so it can’t provide capital growth in these ways, or any other way. For example, you can’t stick a £2 extension on your fiver and double its value. Ain’t happening.

That’s precisely why wealthy people invest the majority of their wealth in hard assets, rather than having it sitting in a savings account, being eroded by inflation.

So when someone tries to sell you on the returns of a savings account over a tangible hard asset, solely because the interest rate temporarily rivals the yield, despite the hard asset’s established history of capital appreciation, you can tell them… Well, actually, I’ll leave that in your capable hands. Just don’t fall for their hogwash.

Bottom line: don’t fall victim to the “fake news” (Christ, I really hate that term, but I’ve said it now, and there’s no going back. I just threw up a little in my mouth!) by neglecting or underestimating the potential of capital growth, as many often do.

Don’t get it twisted: Rental yield matters

No doubt, yield is important, and we all definitely want a decent one, because it will ultimately determine the health of our business’s cash flow. We all want enough cheddar coming in through the doors each month to cover our overheads, including those inevitable and gut-wrenching maintenance issues that will reduce us into sobbing babies.

A low yield is no good.

But the yield ain’t everything when it comes to ROI. That’s what I’m getting at.

Not to sound like a total condescending and sanctimonious prick.

Wait, what? Okay then, If you insist…

I often find that the piece of financial wisdom being offered is usually coming from those that haven’t exactly “made it” Just saying.

They probably mean well, but still, I’m not about to take medical advice from a turnip farmer. Know what I mean?

To clarify, I’m defo not saying investing blindly into any ol’ property will result in fortune and lambos. Buying the right property for the right price is always a thing, along with managing finances, working with good tenants, playing the long game etc. All that good stuff. And yup, while house prices may experience periods of decline and stagnation, what we’re evaluating here is the real value of property relative to the GBP, particularly in the long-term (and which is a better means of preserving wealth, ultimately offering the better ROI). Over time, only one of them tends to always get manhandled by inflation, with little to no chance of recovery. Alas, no amount of good luck can make GBP an appreciating asset or effectively hedge against inflation.

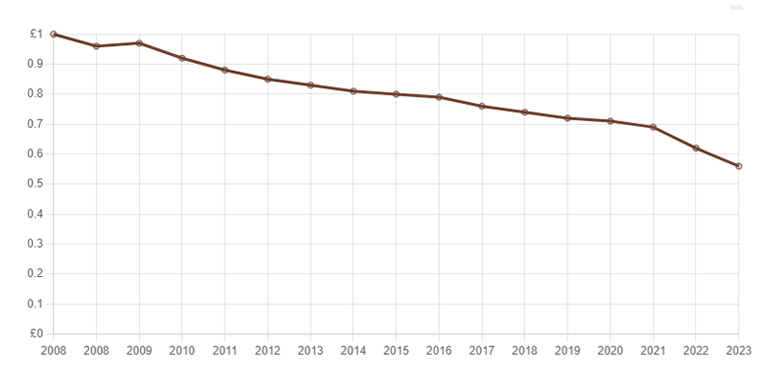

Exhibit A: The value of 1 GBP between 2008 – 2023

The chart below shows how £1 has lost value over the same 15 year period.

Ghastly, isn’t he?

Source: officialdata.org

The simplest way to explain it is (with abstract and fictional numbers):

- £1 in 2008 will buy you 3 pot noodles, in 2023 the same £1 will buy you only 2.

- 1 property in 2008 is worth 20,000 pot noodles, in 2023 that same property is worth 30,000.

While I’m pulling the disclaimers out of my arse, I also want to make it clear that I’m not saying “this investment is better than that investment” – I just know some jobsworth (I’m not talking about you, obvs) will read this post – completely miss my point – and then bore me to death with suggesting superior performing investment vehicles to BTL. Please don’t do it to me *throws up peace sign*

I’m not recommending or suggesting what folk should do with their money – and I never have – that’s not my business.

In conclusion, I’m sticking with property. Thanks for the suggestion though, and I’ll happily take a free organic turnip if it’s on offer.

Landlord out xo

Disclaimer: I'm just a landlord blogger; I'm 100% not qualified to give legal or financial advice. I'm a doofus. Any information I share is my unqualified opinion, and should never be construed as professional legal or financial advice. You should definitely get advice from a qualified professional for any legal or financial matters. For more information, please read my full disclaimer.

Landlord Products / Services

Landlord Products / Services