To summarise this blog post:

- Find out how National Homebuyers service actually works

- Find out if their service is too good to be true, and if there are any catches to be wary of

- Find out how they compare to other property cash buyer services (and if there are better options available)

Oh, will you look at that! National Homebuyers advert just popped up on my TV! I have no idea how long it’s been airing for, but it certainly looks like their marketing budget is in a healthy place.

I’ve also been notified by a colleague that they’re also undergoing a letterbox assault operation, in the form of glossy flyers. Did you receive one of those bad boys?

Of course, I’d be lying through my teeth if I said I didn’t believe this full scale attack was timed with precision, as many homeowners are itching to jump ship as their mortgage payments have spiralled out of control after recent interest rate hikes.

Business must be sweet as a nut.

As with the majority of these “property cash buying companies” (also commonly known as “We buy any home companies“) – and yes, there are a buttload of them – they make a super compelling case for us to sell our house to them pronto.

If you’re in the market to sell, it’s hard not to get enticed by their mouth-watering hooks;

- “Any property, any condition”

- “Guaranteed cash offer”

- “Complete with in 7 days”

- “No legal fees”

- “We’ll buy any ol’ crap for cash”

Well, shit, where do I sign up? Daddy’s got a derelict pile of rubble to get rid of ASAP!

Since their marketing efforts seem to be in full swing, my presumption is that there’ll be an increased thirst for information on National Homebuyers and how these cash buying companies operate. Specifically, what’s the bloody catch (because it all rather sounds too good to be true)?

If that’s why you landed here, then you’re probably in the right place.

Before I kick things off, I just want to clarify that this won’t necessarily be a direct review of National Homebuyers service, but rather an overview of how cash buying companies operate. I haven’t used National Homebuyers services, but I’m familiar with how the industry cogs turn. Essentially, I’m shameless and filthy enough to admit that I’m attempting to piggyback off National Homebuyers marketing efforts to gain traction. But you can rest assured that I’m a straight-shooter.

I’ve broken down this blog post into the sections listed below, so if you’re looking for specifics, feel free to skip straight to the area of interest…

Page contents

- Is there a catch? Are they safe?

- Should you use a cash buying company like National Homebuyers?

- National Homebuyers Vs Other cash buying companies

- Would I specifically use National Homebuyers (based on my analysis)?

Is there a catch? Are they safe?

I’m guessing this is where most eyes will pry, because it’s the most commonly asked question after being confronted with such a compelling sales-pitch by a cash buying company.

Are cash buying companies safe?

I’m going to start off by ripping the band aid off nice and quickly! The property cash buying sector is currently unregulated! That means the industry is full of cowboys ready to rip you a new one – which many of them often do. I’ve heard some horrifically gut-wrenching stories.

Here are some of the most common issues/scams you should be aware of, to name a few:

- Inaccurate valuations which lead to under valuations (the best way to prevent this is by getting multiple valuations from different sources).

- Last minute changes to the offer (i.e. a company will make an initial cash offer and then lower it during the final stages).

- Claims to provide a guaranteed sale for close to 95% – 100% of market value. If they any cash buying company does that, they wouldn’t make any money.

For a more elaborate menu of scams to be wary of, you can read my complete guide to property cash buying companies.

Fortunately, it’s not all doom and gloom. There are plenty of good apples within the space, providing a genuinely fantastic service. I can’t tell you if National Homebuyers specifically is “one of the good guys” because I’ve never used their service. But I can say that they wouldn’t be my personal first choice (more on that in the Would I specifically use National Homebuyers section), but that’s not because they have done anything to tick me off, but rather, I’m more familiar and trusting with other cash buyer companies.

So to answer the question: they can be safe if you use a reputable company!

I know, I know!

That’s about as useful as a chocolate teapot! Don’t worry, I’ll fill in the holes so please bear with.

Is there a catch?

Yes, of course. But it’s not a surprising one. At least, it shouldn’t be, because most of them are crystal clear about the offer on the table.

So, actually, not really a catch, is it?

Reputable cash buying companies will do exactly what they say in the tin – all their glistening and luring headlines stack up – but the kicker is that it’ll cost you. They’ll typically offer anywhere between 75% – 85% of the market value for your property. That’s how they make their money (i.e. buy low, sell high).

That’s the catch.

If a cash buying company like National Homebuyers is offering less than 75% of the market value, then you’re likely being low-balled.

If you’re being offered more than 85% of the actual market value, then you’re likely in the cross-hair of scammers. It’s difficult for cash buyer companies to offer that much and still turn a profit, so if they are, I’d be extremely wary.

Should you use a cash buying company like National Homebuyers?

Oh come on, don’t be like that, you know I can’t answer that question for you.

But what I can say is that their there is definitely a market and place for their services, and they have become incredibly popular among the following:

- Sellers that are after a super quick and hassle free sale

- Sellers with problematic properties/situations e.g. Japanese knotweed, subsidence, occupied by hoarder etc.

- Sellers that have struggled to get a sale on the open market

Needless to say, there is definitely a demand for their services.

Cash buying company Vs Estate Agent

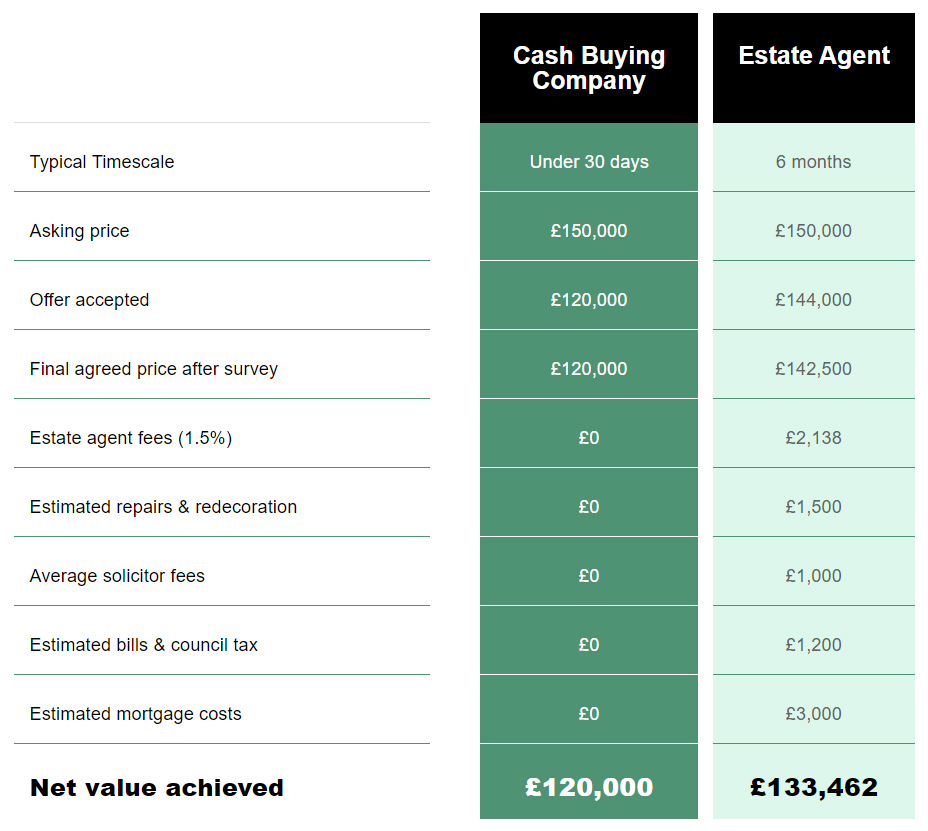

The majority of cash buying companies will occupy their homepage with a nifty little comparison table that highlights their service Vs Estate Agent, which demonstrates a predictably biased overview of why you may want to consider their service over your local high-street estate agency. It goes something like this:

Is it accurate? Well, it does highlight realistic benefits of using a cash buying service, but for one specific example. The reality is, using traditional methods to sell can be a notoriously long process, which in itself comes at a cost (which is what the comparison table shows).

Either way, make of it what you will.

Important: do your due diligence!

If you decide that a cash buying company might be a good option for you, it’s critical to do your own due diligence. Here are a few tips:

- Use a company that is a member of redress schemes (e.g. The National Association of Property Buyers (NAPB), members of The Property Ombudsman and Trading Standards etc.). Is should be clearly stated on their website!

- A competitive and realistic cash offer will be between 75% – 85% of the market value.

- Use a registered company on Companies House

- Check impartial reviews/ratings on platforms like TrustPilot and Reviews.co.uk.

Although, I’m increasingly sceptical of reviews these days, because a lot of them seem to be fake (not all, mind you), so that’s something you may want to bear in mind.

National Homebuyers Vs Other cash buying companies

I won’t dive too deep into this section, but just realise that National Homebuyers is just one out of several dozens of these companies to choose from; some are better rated, some lower.

I’ve actually compiled a list of recommended cash buying companies, which you can check out. And before you ask, nope, sadly National Homebuyers didn’t make the list (I explain how someone makes my list on that page).

Would I specifically use National Homebuyers (based on my analysis)?

Since there’s a high probability many unsuspecting folk will land on this page (and abomination of a blog) after Googling “National Homebuyers review” (or a variation of those keywords), I should probably share my initial and objective thoughts on their service.

In short: Nah, I wouldn’t use their service from the perspective of a window-shopper.

To clarify once again, I haven’t used their service, so I’m basing my thoughts on anecdotal evidence. Also, don’t get it twisted, I’m not telling anyone not to use their service, because they seemingly do have a good reputation and they have been around for a long time. However, I am saying I personally wouldn’t, and that’s for the following four reasons:

- My Homebuyers: first and foremost, I genuinely believe MyHomebuyers.co.uk are currently the best property cash buying company around, and that’s why they would be my first port of call if I was looking to use a service like theirs.

My Homebuyers / Property Cash Buying Company Service Rating Features Offers (up to) My Homebuyers

Rating

TrustPilot ReviewsFeatures - Guarantee to beat any genuine cash offer

- Members of The National Association of Property Buyers, members of The Property Ombudsman and Trading Standards

- Any property, any condition considered (England or Wales)

- Cash offer within 24 hours, Sales completed in as little as 7 days

- Free Legal fees included, No agent costs or hidden fees

- Guaranteed sale

Offers (up to)

80-85%of Market ValueGet cash offer And nope, this isn’t a sponsored blog post, but they are an affiliate partner of mine (only because they’re awesome, though), as are a few other cash buying companies (which I didn’t proclaim as my preferred choice).

For a detailed justification, you can read my review on My Homebuyers if you want.

That said, I still think it’s imperative to do your own due diligence, which should include getting a few quotes from different companies, which may or may not include National homebuyers and MyHomebuyers.co.uk.

- Members of redress schemes: most cash buying companies make it very clear if they’re members of redness schemes (e.g. The National Association of Property Buyers (NAPB), members of The Property Ombudsman and Trading Standards etc.) – because it’s so incredibly important to be in an unregulated sector.

Usually, there are redness logos at the bottom of every page of the website.

I’m not saying National Homebuyers aren’t members of any (it’s easy enough to find out, and they probably are, to be fair), but I can’t see any evidence of it from looking through their website. Maybe they’ve tucked the information away in the small-print for some very peculiar reason.

In the famous words of Duncan Bannatyne, “I’m out” (Scottish accent)

- Legal fees capped to £1000: it’s interesting that they have capped legal fees, because I imagine legal fees can easily exceed that amount in difficult cases. Ironically, cash buying companies usually deal with difficult cases. Either way, my bet is that they can’t always anticipate whether legal fees will exceed the cap until after the fact. That’s concerning.

I’m not saying other companies don’t also cap legal fees, but National Homebuyers is the first one I have seen that does.

- Cash offer amount unclear: there’s no indication of how much of the market value they will offer, at least not from what I can see (maybe it’s hidden in the depths of the small print. If so, that’s even more concerning!). Almost EVERY company’s website I have seen makes it pretty clear (as mentioned, it’s usually between 75% – 85%).

I don’t see any reason to hide this information unless they’re not particularly competitive. That said, there’s only one way to find out if they are competitive, and that’s by getting a cash offer.

Either way, alarm bells are ringing because they have chosen not to make it clear.

- My friend said…: Following on from my previous point, I believe I know of one reason why they don’t clearly specify how much of the market value they offer.

A very reliable and trustworthy source informed me that he came into contact with someone that recently had a poor experience with National Homebuyers. After a sale price was agreed, they kept reducing their offer, so the seller eventually pulled out of the deal.

I must stress, this is hearsay, but I do trust my source. Make of that what you will.

I also know that the practise of dropping the initial and generous offer price at the last minute – sometimes as late as completion day – is rather common by the more heinous cash buyer companies (I’m not saying National Homebuyers are point-blank a heinous operation, but the feedback isn’t exactly inspiring).

Time to wrap it up, folks.

In conclusion, if you feel interested in going down the route of using a cash buying company, have your wits about you! It’s an industry plagued with bad actors. However, find the right company to work with, and your house selling service can be a wonderfully simple experience, especially for anyone with a difficult edge case.

Happy selling!

Oh, and before I make like a banana and split, please drop a comment if you’ve used National Homebuyers or any other cash buying company, I’d love to hear your feedback!

Disclaimer: I'm just a landlord blogger; I'm 100% not qualified to give legal or financial advice. I'm a doofus. Any information I share is my unqualified opinion, and should never be construed as professional legal or financial advice. You should definitely get advice from a qualified professional for any legal or financial matters. For more information, please read my full disclaimer.

Landlord Products / Services

Landlord Products / Services

Lost a sale of £80k in sept 22 due to a previous solicitor fault . Oct 22 up for sale again £75k offers over auction . Letter from homebuyers telling me they are buying in this area , I replied out of interest and boredom just to see . They offered £55k without vaseline . That's just being vultures preying on some people's desperation . Not for me