Dealing with one estate agent seems frightful enough, but dealing with multiple… who would self-willingly endure the pain?

Apparently the people that want to effectively sell their home quickly.

But how effective is using a multiple agency strategy, and why is it that professionals, which includes developers, investment funds, probate managers, all tend to use it, while 94% of individuals use one sole agency?

Should you use multiple estate agents to sell your property for a quick sale, and if so, what’s the best way to do it? Walk with me…

Table of contents

- Estate agent contracts explained!

- Why home-sellers use multiple estate agents!

- When using a multi-agency strategy will NOT work

- Why property “experts” use the multi estate agent strategy

- How to use multiple agents and pay low fees!

- After the quickest sale possible (then don’t use the multi-agent strategy)?

Estate agent contracts explained!

First and foremost, let’s quickly go over the most common contractual agreements vendors have with their local agent. It will help create a clear picture of the overall scenario.

When instructing an agent to sell your property, you’ll most likely be presented with one of the following options:

- Sole agency agreements – this is the most common agreement used by estate agents.

It gives one agent exclusive rights to market and sell your property for a set period (usually 8–16 weeks). During this time, you cannot instruct another agent without breaching the contract.

It’s advisable to negotiate the shortest possible term to retain flexibility in case you’re dissatisfied with the service (remember, we’re dealing with estate agents here!).

You only pay the agent if they find a buyer. If you find a buyer yourself during the agreement period, you won’t owe the estate agent anything. The typical estate agent fee for sole agency is 1-2% of the sale price.

- Sole selling rights – this is often confused with ‘sole agency’, so it’s important to understand the difference before agreeing to the terms.

Sole selling rights is similar to sole agency, but with one key difference: you must pay the estate agent even if you find your own buyer, such as a family member or friend. This type of agreement is more commonly used for commercial properties.

- Multiple agency agreements as you’d expect, this type of contract allows you to use more than one agent to market and sell your property at the same time.

Because this scenario naturally creates extra competition between agents, they typically charge a higher commission fee of the sale price, usually between 2.5% – 3.5%+VAT (instead of the usual 1% – 1.5% you would expect to pay under a sole agency agreement).

You don’t need to pay every agent you instruct, only the agent that gets the sale.

May the best chump win, right?

- Ready, willing and able purchaser – avoid, avoid, avoid! Any agreement that comes with this clause is total garbage.

If this clause is in your contract it means you’ll be liable to pay the estate agent fee even if you decide not to sell (for whatever reason).

Toss it in the bin.

It’s worth noting that agreements can be updated (i.e. you can switch from ‘sole agency’ to ‘multiple’ earlier than contractually agreed upon) or prematurely terminated as long as there is a mutual agreement between both parties. Otherwise, both agent and seller are obligated to adhere to the terms of the agreement.

Needless to say, it’s critical to carefully check the terms and conditions of any agreement before you sign it.

Why home-sellers use multiple estate agents!

- Access to more buyers

Many people assume that there’s generally no difference between using one or two local agents, because inevitably, the property is going to get launched onto Rightmove and Zoopla, and it’s going to attract all the same eyeballs anyways.That’s actually a common misconception.

The most successful and resourceful estate agents accumulate leads from several sources, not just the portals, and many of those sources are unique to them. If you opt for using a couple of reputable and established agents, you potentially get access to more protective buyers.

- Quicker sale and higher offers!

Obviously the more agents you have scrambling around trying to shift your property, the more potential buyers you will reach, and potentially the higher the offers you will receive. Multi agency agreements usually make traditional estate agents work harder because of the competition and the higher cash prize.On average an estate agent will only sell 50% of the houses they market, so that means using more than one agent will significantly improve the chances of your property being whisked away.

When using a multi-agency strategy will NOT work

Hold your horses. Maybe.

As wonderful as this whole multi-agency approach sounds, it’s unlikely to work for everyone, namely because of the following two reasons:

- The property is in area with insufficient agency density. For example, if you live in the ass-end of nowhere and there’s only two agents in town, then this approach is going to be useless for the obvious reason (if someone is looking to buy [in the ass-end of nowhere], they’ll just engage with both agents on their own will, so those homes will already have every buyer in their scope).

- The property is less than £200,000 (or thereabouts). This is just my opinion, but from experience I can confidently say that it’s tough to motivate agents to sell a property on a multi-agency agreement if the commission is too low. The reality is, competing against other agents adds an element of risk for agents, because their chance of getting the sale dramatically decreases.

The most effective strategy will be based on a dangling carrot that all the agents want, because that’s how you get a motivated and energetic workforce.

Why property “experts” use the multi estate agent strategy

As mentioned, the professionals with in the industry tend to favour the multi-agency strategy when they’re selling. But why if they have to splash out more on commission?

The reality is, the property boffins aren’t paying the same rates as individual sellers that agree to a multi-agent agreement.

Unfortunately, while us mere mortals are lumbered with the ‘sucker rates’, the pros are groomed with significantly lower rates because they’re regular customers that sell in volume. Meanwhile, the average UK homeowner sells their house every 9 years, so agents aren’t incentivised to offer us those reserved glamorous low fees.

So while most of us have to dig deep and splash out on a 3% commission bill if we want to use multiple agents, the big-wigs are probably paying half that, because the local agents want their lucrative recurring business.

It really boils down to economies of scale (i.e. commodities and services get cheaper as you scale up).

So should you become a professional property mogul and start dealing in volume?

You could, if you really want to.

But it’s an unlikely solution.

How to use multiple agents and pay low fees!

The solution

Interestingly, this crusty old blog post was originally written in 2013 (I think I’m going to be vomit!), but I’ve been forced to update it [in 2024] because of an interesting (and relevant) service that’s managed to worm it’s way onto my radar.

I think I may have discovered a legit solution for anyone craving to benefit from the perks of using multiple agents, but for the same price as a sole agency agreement (or thereabouts)!

A company called flyp recently infiltrated my inbox with an interesting sales pitch.

Great, another one! 99.99% of them are inevitably destined to be air-planed into the bin, so my enthusiasm and expectations are usually non-existent.

flyp claim to have a cure for our ailments (needless to say, just like every Tom, Dick & Harry does). In short, their service allows homeowners to have the top-performing local estate agents simultaneously work to sell their property, all for a typical fee of 1.5% of the sale price (which is the standard rate for most sole agency contracts).

In other words, a multi-agency strategy for the price of a sole agency strategy.

(Right, they’ve managed to pique my interest. Let’s hope they don’t screw this up.)

The how

flyp are able to negotiate better rates with our local agents than we, as individual sellers, could ever dream of, because flyp can use the large volume of properties they have in their books as hostage leverage.

Open sesame! Hello, glamorous low fees!

The results

flyp fully manage and deploy a multi agency sales strategy for a sole agency fee, and by doing so, they claim to achieve an 85% sales rate on average (compared to the standard 50% achieved by a single agent) and an offer within 3 weeks 80% of the time.

Bold and alluring claims.

| Service | Rating | Notes / Includes | |

|---|---|---|---|

Service | Rating TrustPilot Reviews | Notes / Includesflyp’s service is designed to help homeowners sell their property as quickly as possible while securing the highest price.

| Book FREE Appraisal |

The logistics of the service

You don’t deal with the agent(s) at all, you only deal directly with your flyp account manager, who will keep you updated on viewings, offers, and handle the entire management of your property until completion.

flyp does all the donkey work, including negotiating directly with your local estate agents and getting them on board to market your property across their various channels.

The cost

Right, let’s talk turkey.

- Upfront Fee (offset against the final bill)

- Pay an initial fee of £375 + VAT to flyp.

- This fee is guaranteed: if flyp doesn’t engage at least 5 agents for your property sale, you get a full refund.

- The upfront fee is also offset against the final bill.

- Agent Engagement

- flyp contacts local agents on your behalf and negotiates their sales fees (typically 1.5% of the sale price).

- You are consulted to approve the agreed fees before proceeding. If you agree, all engaged agents will commence marketing your property.

- Sale Commission Structure

- When an agent successfully sells your property, you pay the agreed fee (e.g., 1.5% of the sale price).

- Out of this 1.5%, the agent pays flyp a fixed fee of 0.25% (in other words, you never hand over any cash to flyp directly).

- Summary of Payment Flow

- You pay flyp the upfront fee (£375 + VAT), which is offset against the final bill.

- If a sale occurs, you pay the selling agent their negotiated fee (e.g., 1.5%).

- The agent then pays flyp 0.25% from their commission.

I’m sold, which is why I agreed to partner with them. Genuinely sounds like a sweet deal to me. Ultimately, if I have a choice between a multi-agency strategy Vs sole agency strategy for the same fee, it’s a no-brainer.

How to get started (or find out more)

To find out more, jump over to my in-depth review of flyp’s services, or enter your postcode below to start the journey of getting a free, no-obligations appraisal.

Just to clarify, I’ve never used flyp’s service, therefore I cannot recommend them based on personal experience. But there’s enough buzz around the web to conduct your own due diligence to determine if their multi-agency service is a viable option for you.

I’ve done my own due diligence, which resulted in being comfortable in partnering with them and recommending their service. I’ve also noted that flyp’s service is being touted on theadvisory.co.uk (apparently that’s a big deal *shrugs shoulders*). flyp has also been featured in some pretty notable publications, such asThe Times, Forbes, Bloomberg etc. Make of that what you will.

After the quickest sale possible (then don’t use the multi-agent strategy)?

Using a multi-agency strategy is definitely a proven means of turbo charging a house sale, however, it’s not the quickest.

If your intent is to achieve the quickest sale possible (which is often the motive for using a multi-agent strategy), then I’d be remiss if I didn’t – at the very least – lightly touch on services provided by Cash House Buyer Companies (also known as We buy any house companies). They appear to be growing in popularity among homeowners that are itching for a quick sale, which is why these companies are popping up all over the place.

I know what you’re thinking. And you’re right. These services aren’t for everyone and you do need to proceed with caution.

Cash House Buyer companies pride themselves on buying property off anyone that wants a super quick sale (within as little as 7 days) for hard cash.

The catch? You’ll need to accept an offer anywhere between 75% – 90% of the market value.

Nope, it’s not the perfect solution, no doubt about it, but it’s a trade-off many willingly make; selling quickly for less does have its advantages, especially in a stressed market (i.e. when the market is stagnant and prices are declining).

For all intents and purposes, using one is going to be the quickest route to get a sale in most cases – much quicker than going down the traditional and multi-agency routes. That’s why I thought I’d mention it.

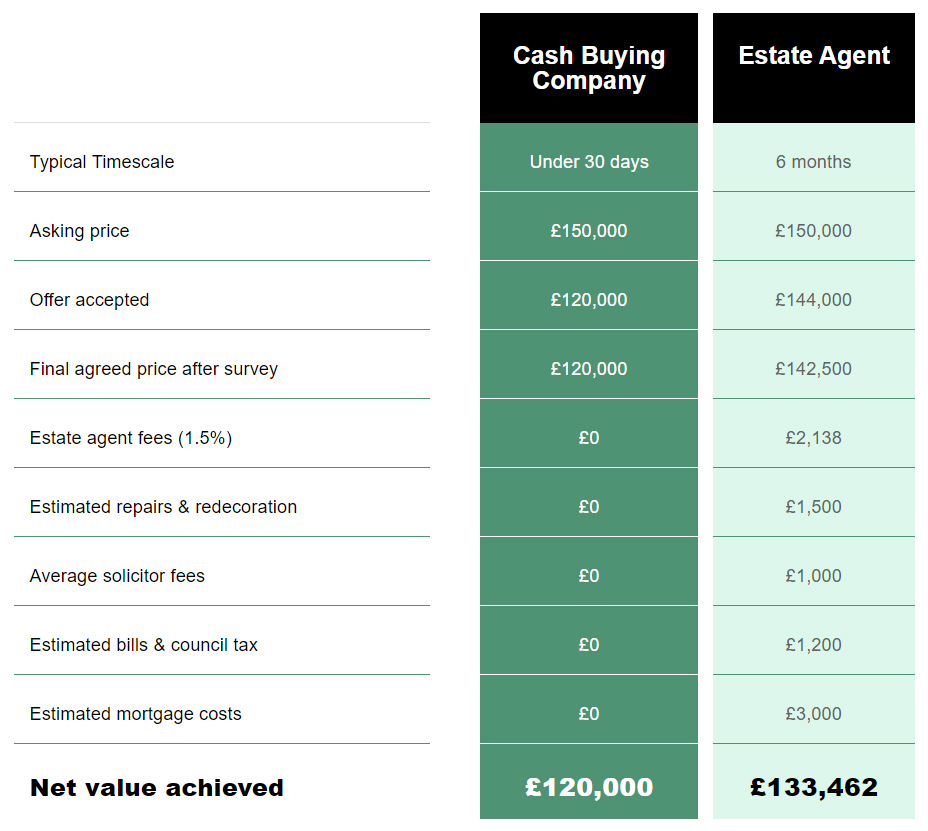

Below is an example of what is possible in terms of costs/net value when using Cash House Buyer Company compared to a traditional estate agent. I snatched the example from one of the company’s websites, so make of it what you will (I’m just the messenger, so please don’t shoot)…

They sure do paint a pretty little picture, don’t they?

But how accurate is it? Well, it does highlight real benefits of using a cash buying service, but for one specific example. The reality is, using traditional methods to sell can be a long process, which in itself comes at a cost that many don’t consider (but should), and I think that’s what the comparison table shows more than anything else. Basically, time is money.

My HomeBuyers is an example of a reputable Cash House Buyer Company, and below is an overview of their services (so you get a gist of what you can expect from these services):

| Service | Rating | Features | Offers (up to) | |

|---|---|---|---|---|

My Homebuyers | Rating TrustPilot Reviews | Features

| Offers (up to) 80-85%of Market Value | Get cash offer |

Buyer beware, the cash buyer industry is notoriously full of sharks, so it’s important to do your due diligence and use a reputable. If your interest has piqued and you want to find out more, I recommend having a sniff through my complete guide on Cash House Buyer Companies.

Disclaimer: I'm just a landlord blogger; I'm 100% not qualified to give legal or financial advice. I'm a doofus. Any information I share is my unqualified opinion, and should never be construed as professional legal or financial advice. You should definitely get advice from a qualified professional for any legal or financial matters. For more information, please read my full disclaimer.

Landlord Products / Services

Landlord Products / Services

Hi, I used Movewise after reading your article above and they were excellent. Though we managed to sell with the first agent who marketed the property it was great to have someone from Movewise guide the process and hustle the solicitors when needed. We had failed to sell the year before and our adjoined neighbour had also failed to sell in the current year. But with Movewise we got a result. I would recommend them.