Many are speculating, with good reason, that we’re at the peak of the current property market cycle and the point of capitulation is nearing. That means anyone that purchased property recently, will likely feel – at the very least – a sledgehammer to their net worth. That’s going to scare people, maybe even you.

There’s a storm brewing. I feel it in every fibre of my strap-on.

However, I believe we, as property investors, should take comfort and privilege in the fact that we have stored wealth in property during uncertain times, and no one should be feared out of the game unnecessarily! Alas, it happens during every downturn – landlords panic and in extreme cases throw in the towel, for all the wrong reasons.

I don’t know the future, no one does, it’s entirely possible that the source of my unnerved core is my gut struggling to digest last week’s seafood chowder. But I do know that if the market doesn’t shit the bed any time soon, it will eventually, and before that happens, I want to share with you what happened to me in 2008, during the most epic economic shit-storm in my lifetime.

This blog post is for any sensible landlord/property investor that tried to do things the right way, but finds themselves in fearful market conditions, whether it be in 2008, 2022, or 2150!

If you’re feeling anxious or concerned about your landlording and property investment endeavours, I hope my story gives you hope…

What happened to me in 2007-2008 (during the previous property crash)

I know many of you were around back then, albeit with fewer grey hairs and less saggy ears, so you went through it with me. I remember it vividly, like the first time I discovered sexual intercourse standing-up is not effective contraception. Horrifying.

There was peak euphoria, and everyone thought property prices could *never* decline ever again. Property TV shows like Sarah Beeny’s Property Ladder had exploded in popularity, giving every dumb-arse hope of effortlessly obtaining property millionaire status.

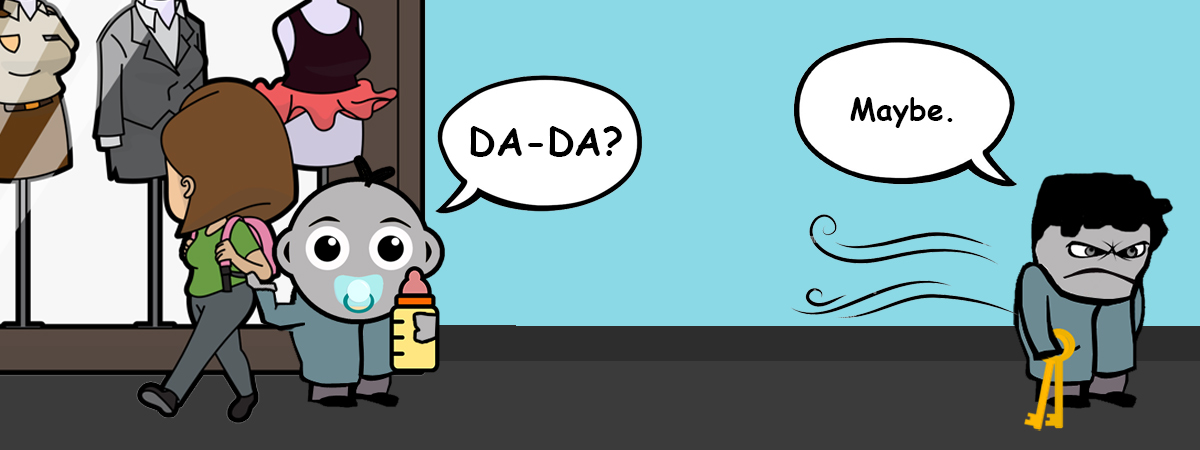

Your favourite dumb-arse just happened to have purchased 2 properties in 2007, literally at the tail end of an almighty property boom. I may have experienced 6 months of growth before the global markets fell on its arse overnight. One day I was window shopping for a Lambo, the next day I was flogging my nan’s used Tupperware on ebay without her permission.

The financial markets could not take the abuse anymore, so it finally snapped.

- Property prices declined between 20-50%

- Repossessions and defaults skyrocketed.

- Borrowers could not remortgage because they suddenly found themselves drowning in negative equity (their debt exceeded the value of the property), which meant:

- when borrowers came out of their fixed-rate term, they were stuck on exorbitant standard variable rates (which many couldn’t afford);

- borrowers would need to invest more capital into their sinking ship if they wanted to remortgage.

- People panic sold and cut their losses, and mortgages became harder to obtain (20% deposit became the minimum), both of which added downward pressure on house prices.

Yup, they were bloody awesome times. I used to sleep with a sick bucket next to my bed.

Interestingly, before the crash, BTL mortgages were so comical that they were based on potential rental income, and not the income/salary of the borrower. Can you imagine?

In hindsight, the crash was inevitable. The financial world had taken ‘complacency’ and injected it with anabolic horse steroids, dishing out 110% mortgages (yes, really!) for fun, to people that didn’t have a pot to piss in. I’m getting a similar whiff of evitable doom right now – with all the money-printing and hand-outs that occurred during the height of the pandemic, it feels like somethings gotta give.

In any case, bone me in the ass with a wooden mallet, 2007/2008 was a catastrophe. I was scared.

- My 2 properties dropped by 30% in value.

- I had 40% equity in each, so I was left with 10% by the time we hit the bottom (not enough to remortgage anytime soon). Can you imagine what happened to those that bought in the peak with a 100%+ mortgage? Total annihilation. That’s precisely why my best advice for new landlords has always been to ignore those that shill short-cuts and get rich quick schemes, but rather, focus on building equity from the offset (i.e. put down big deposits and clear debt). I know how quickly the tide can turn, and if it does turn while you’re gambling… OUCH!

- I had to endure horrendous stretches where my rental income was significantly short of covering my overheads.

- Anxiety levels were off the charts. I went through all the emotional clichés, most notably feeling like the situation would never improve.

Just to clarify, I do NOT believe things are going to get that bad during this cycle.

What I did during the property crash to survive

First and foremost, I didn’t sell shit. Cutting my losses was not an option, even though many of my peers were doing exactly that. Screw that, breaking-even wasn’t even an option. Who is here to break-even?

When I buy a property, it’s a long-term BTL investment strategy, and that means:

- 10 years minimum investment

- The up and down trends in-between are irrelevant when I don’t plan on selling

- I expect some pain during the process

- Only sell into a booming market, not into a torpedoed one

- Don’t try and time the top or bottom of the market

My strategy to navigate through the crash was simple:

- Listen to the facts, not my emotions or the doom-and-gloomers. The facts do not lie: property prices have always trended upwards over time, and until the facts change I have no reason to believe history won’t repeat or at least rhyme.

- Continually remind myself that I didn’t enter the game to buy high and sell low. It’s easy to lose focus on why we’re here in the first place when things aren’t going to plan.

- Not to panic, and to carry on with business as usual, adjusting the strategy accordingly.

- Aggressively overpay debt as much as I could.

- Buckle down and make more money. I had a full-time job and worked part-time at the weekends.

- Remortgage onto better deals at every opportunity

Was it tough? Did I have to make sacrifices? Pissing hell YES!

What happened 10 years later?

I’m massively up on both investments; they’ve pretty much doubled in value and are producing high-yielding rental income.

Shhhheeeet, I’m sitting here iced up to the gills. How many carats you got up in your pie-hole, son? I’m exposing 50 G’s every time I open my trap.

What ya got? Four cavities filled with mercury? Shouldn’t have panic sold your merchandise, bruv!

I can tell you, without any doubt whatsoever, if I had listened to all the Debbie-Downers that were shitting on my lunch and in their pants, calling for the end of the world case scenarios, I would never have forgiven myself.

One of the properties is mortgage free today, the other has a 20%’ish balance remaining, with cheap debt (0.89% interest rate). And as soon as that mother bitch exceeds my savings account interest rate, I’m going to switch the loan’s lights out ASAP (i.e. overpay the debt).

I’m not rich, but I’m richer, and I’m getting closer to meeting my objective.

Patience and focus. Do NOT panic.

What’s my point?

I got through the pain before, and I’ll do it again with you.

If you’ve invested sensibly and you’re ever in doubt, widen your timeframe, and believe me, history says you will be absolutely fine. Investing in property long-term has NEVER failed. Until it does… *sticks fingers in ears* LA LA LA LA!

Hell, there might come a time when I do panic and become fearful, but I won’t allow those emotions to dictate my next steps.

What is the most fundamental aspect of property from an investment viewpoint? There will always be demand for it. You cannot say the same for precious metals, stocks, crypto etc. That should be comforting for every landlord, even during the darkest of times.

That is precisely why I consider BTL the best investment.

Why incoming property crashes do NOT fear me anymore

In times of uncertainty, human psychology will always provoke irrational fear in people, and those that fall victim will not fail in trying to spread their fear like the plague, that I am sure of. They will always be the one that:

- insist it’s impossible to make money from property anymore!

- insist “it’s different this time“, the property apocalypse is here for real!

- liquidate their assets and encourage everyone else around them to do the same, often insisting the best approach is to “time the market” by selling low and waiting to buy back in lower. Yes, like trying to catch a falling knife is ever a good idea.

- list everything wrong with the market, from economic to legislative concerns.

It happens EVERY TIME when people get fearful, and it just becomes a self fulfilling prophecy for those pay attention. Listening to the negativity is draining and it can be infectious. In reality, the negative Nancies just want you to feel as fearful as they do, which is why they spread fear.

I’m seeing very early signs of the same patterns I saw in the previous crash.

Know why I refuse to believe them, remain positive and focused on my own path?

Because nothing has changed!

The past has written the future, so anyone that feels forced to make irrational decisions either has no choice (i.e. they have taken on too much risk), or they’re needlessly being feared out of the market. Many fall into the latter camp, and that shouldn’t happen, because until a fundamental shift occurs, why should we expect a different outcome?

Booms have always followed busts. So as I’ve said, until the facts change, I ain’t listening to shit. Don’t tell me the sun won’t shine tomorrow when it’s been doing it every day of my entire life.

I will stick to the game plan with confidence.

Here’s the real irony: because I didn’t make any rash decisions during the previous crash – even though it was damn compelling to do so – I’m now in a position to scoop up a bargain once we enter the darkest depths of the next bust phase of the cycle. That’s how you do it.

My story is not unique, it’s one of thousands.

Property crashes are healthy and necessary

As much as it hurts, price corrections are healthy – nothing can go up forever – they cleanse the market of viruses (i.e. greed).

During the last crash, the bulk of casualties consisted of those that took on excessive and unmanageable debt. I believe that will happen during every crash, but not to the same degree as the last one, because since then the criteria for lending became significantly tighter. Lessons were learned.

However, during this cycle, a different virus has emerged. A new one always does.

I’ve been very vocal about my concern regarding The Toxic Rise Of Social Media “Property Experts”, selling dog-shit property courses for silly money, teaching nonsense like rent-to-rent, and various other “low-entry” methods of investing in property. Essentially, unsustainable junk.

I predict the resilience of these schemes are going to get tested and exposed during the next storm, and the participants are going to form the bulk of the casualties. It won’t be a slow and painful death either, it will be a prompt slaughtering, because these particularly flimsy and over-leveraged strategies are designed to function in only ONE type of environment: a blossoming one!

It’s likely interest rates will continue to rise to help curb inflation, resulting in less money circulating in the economy. As always, the people at the bottom will get hit first and the hardest. In other words, rent arrears will increase, and that’s when the Rent-to-rent landlords are going to realise why propping up sub-letting portfolios with pennies is just plain silliness.

Final thoughts

My intention isn’t to encourage anyone to buy, sell or hold, I can’t make that decision for anyone. My intention is to encourage you to remain confident in the process, and not to lose conviction during tough times, because the odds are heavily in our favour. So make the right decisions for yourself on your own terms.

I want you to succeed.

If you ever find yourself wondering if the slog is worth it, I hope the sweet-ass rocks in my gob answers your question. That’s a 50 G smile, baby!

Stay strong, my friends xoxo

Disclaimer: I'm just a landlord blogger; I'm 100% not qualified to give legal or financial advice. I'm a doofus. Any information I share is my unqualified opinion, and should never be construed as professional legal or financial advice. You should definitely get advice from a qualified professional for any legal or financial matters. For more information, please read my full disclaimer.

Landlord Products / Services

Landlord Products / Services

Great piece as usual. Even if I don't agree with some of your posts(sad thing is I do agree with nearly all of them!) they are always enjoyable and fun to read. Keep it up Landlord blogger.