Besides from tragic loss of life and the rise of the bog-roll foot soldiers, another tragic consequence of the coronavirus is the global financial devastation it’s causing, from the bottom to the top middle.

People say that socialism doesn’t work, which might be true, but equally, a system that is designed to starve out the less fortunate first is not a working solution either. That’s what is happening, and it’s going to continue.

Cororavirus is going to impact every single business one way or another, either directly or indirectly, through the virus or through fear.

So I can’t be the only landlord concerned about the possibility of the coronavirus pandemic causing an increasing chance of eventual mass rent arrears, and therefore contemplating whether it’s time we started engaging in combat over Rent Guarantee Insurance (RGI) products, like normal civilians are doing over bog-roll? Ya’ know, just in case.

I honestly don’t know the answer.

I’m just asking the question and interested in your thoughts.

I want to know whether you’re concerned about how the coronavirus may impact your BTL business, and specifically how it might impact your tenant’s ability to pay rent? If so, have you taken or considered taking proactive steps to mitigate potential damages?

I certainly have.

It’s profoundly batshit crazy out there!

I went into my local Tescos Superstore last night; the toilet roll and pasta isles were both decimated wastelands. Literally, not a single loose penne tube in sight, not even a random stowaway. The tinned tuna isle was noticeably sparse, too.

When I walked into my gym the other day, I caught eye of a comically distressing notice on the reception desk, warning all members that if anyone is caught stealing bog-rolls from the vicinity, they will receive a lifetime ban. Apparently some numpty was caught trying to smuggle away a gym-bag full of the stuff.

What-the-actual-F?! These apocalyptic-dummies have lost their loopy marbles.

Moreover, the circulating video clips of assholes physically scrambling over household supplies in grocery stores is a reminder of how little we have evolved as a species, and how similar (and basic) our human genomes still are to chimps.

Embarrassing.

Whether it’s justified or not, the irony is, fear could create bigger problems than the coronavirus itself. I’m actually starting to wonder which virus poses the most danger, human nature or COVID-19.

Rent Guarantee Insurance (RGI) is always sensible, but is it more so now?

I’ve ALWAYS endorsed splashing out on RGI cover, specifically for new tenants. I tend to push it less when a landlord has developed a healthy relationship with a tenant that’s proven to be reliable, and in those instances I have no issues with allowing the policies to lapse. Renewing them is cool, too.

However, those principles don’t seem to apply right now, because mass-scale panic plays havoc with rationality, so now, not only do we have to protect ourselves against a deadly virus, but arguably the bigger threat: crazy.

The stats imply that there are already circulating viruses that could just as easily take us out before coronavirus, but they’re currently far less damaging because they’re not being marketed by a tsunami of panic and hysteria. Exhibit A: the empty shelves.

My point is, whether people are overreacting or not is irrelevant, because people ARE worried, and fear inevitably breeds more fear, and that’s causing less consumer activity, which is causing loss of earnings. That’s going to affect landlords all over the world, even if the virus doesn’t.

I literally experienced one short flurry of coughs this morning, and that was enough for me to start questioning my seemingly failing health, and commence with self-diagnosing on Google (literally, the worst way to self-diagnose any ailment if you want to retain your sanity).

Apparently my symptoms indicate that I could have cancer, herpes, a verruca, a cold, the flu, coronavirus, unknowingly lost a kidney, or I may have just swallowed too much air. Either way, it’s best you don’t touch me. Verrucas are nasty and super contagious.

That’s the kind of shit which is going to cause much of the damage. Psychological warfare. And hypochondria.

Planning for the worst… today!

Landlords should always protect themselves against unforeseen circumstances, and new events shouldn’t suddenly invoke sensible measures to limit damage control.

But the reality is, some of us will need to tighten up our ships due to the heightened level of risk and insanity we’re being exposed to. I suspect the internal organs of the rental market are going to start shutting down, if they haven’t done so already.

Will coronavirus affect your BTL business?

I don’t know. It’s likely.

Will it be as big as people fear?

I don’t know.

But what I do know is that the fear is real.

The true result is unknown, but some people seem to be anticipating the end of the world, and they’ve managed to find comfort and reassurance in stock-piling tools that keep their asses polished as part of an overall solution for the survival of mankind. It’s an interesting tactic, but I certainly won’t be participating. I have leaves in my garden. Lots of them!

This isn’t the end of the world, and much of what our lives look like after we get through this will depend on what we do now. It doesn’t matter how much bog-roll you have stored in your loft, it will not change your future in any meaningful way.

Whether you’re going about your day as normal (but taking a few extra precautions), or you’re a lunatic, smashing peoples teeth out of their ears over the last bottle of hand sanitiser gel, the cost of waiting to administer reasonable defences is often the most expensive route, and it’s usually those that don’t prepare for the things that matter whom are left the most vulnerable.

Probably the biggest mistake, we as professional landlords (that includes EVERY single one of you, from single to portfolio), can make is to remain idle, be complacent, and shake our tenant’s filthy rotten fungus hands.

Incidentally, as I’m writing this, I’m also listening to Sky News live. Dr Michael J Ryan, the Chief Executive Director of the WHO Health Emergencies Programme, just responded with the following when asked what lessons were learnt from previous outbreaks, which can be applied to dealing with coronvirus:

‘speed’ trumps ‘perfection’

the greatest error is not to move

I’m not saying we should panic.

I’m not saying everyone should rush out and scramble for RGI policies – that may NOT be a solution for you – that’s merely a solution that quickly came to my mind, for me. I think it’s far more critical to stress-test the consequences of rent arrears for you today and then plan accordingly. Will you be able to manage? If not, what practical steps can you make today to plug the holes? Essentially, do everything sensible landlords should be doing anyways.

Personally, I think guaranteeing rent is an obvious precaution to take, but not the only one.

Coronavirus damage control: precautions that come to mind!

I imagine a market slowdown is imminent, although I can’t be certain. So I want to emphasise the fact that this exercise is about anticipating likely dangers and preparing, nothing else. I’m not trying to quantify the scale of the problem for today or tomorrow.

1) Build a cash reserve (if you don’t have one already)

For most it’s probably too late, but if there’s any opportunity to build a cash reserve in the coming weeks and months, do it!

Pile it up, pile it good!

You really should have had one already. You know that.

2) Rent Guarantee Insurance (RGI)

I haven’t reduced myself to joining the penne pasta and bog-roll looters (yet), but it could be fair to label me as an RGI bandit. I snapped up a few policies, and no one could have stopped me even if they tried.

BACK OFF, BARBARA!!! Get any closer to me or my policy and I will hang your intestines around my neck like a 9 carat chain! DO NOT TEST ME, PENIS-BREATH!!! I WILL DISARM YOU AND GUT YOU LIKE A TROUT!I don’t know if it will happen – and I don’t wish to cause any panic – but I wouldn’t be surprised if RGI products start becoming more restrictive and/or being pulled off the shelves, because I suspect insurers may anticipate a surge in claims. Most travel insurance policies have already become limited, restrictive and more expensive, and I also heard that wedding insurance is near impossible to purchase now.

Here are a couple of options if anyone is interested in becoming an RGI bandit, too:

Landlord Rent Guarantee Insurance (RGI) Providers Supplier Rating Term Details Price from Supplier

Rating

Google ReviewsTerm

12 monthsDetails Included

- Free 14-day no quibble cancellation

- Tenancies with up to £3,000 monthly rent guaranteed

- Up to £50,000 total cover

- No excess on claiming

- Free legal helpline for duration of policy

- Policy still valid if tenants change (subject to referencing and £20 admin fee)

Requirements

*Each named tenant must have passed OpenRent’s Comprehensive referencing within the last three months. This should be done before applying for RGI. You can order an OpenRent Comprehensive Reference online for £20.

Price No excess fees

£199Inc IPT

More details *Order OpenRent’s Comprehensive referencing first if required.

Supplier

Rating

TrustPilot ReviewsTerm

12 monthsDetails Included

- 100% of rental income if the tenant fails to pay

- Up to £50,000 Legal costs coverage

- 50% of rent paid for a further three months post eviction

- New or Existing tenancies without any no-claims penalty period

- 24/7 legal helpline

Requirements

Each named tenant must have passed a LegalforLandlords Smart or Complete or an approved full reference from another supplier. This should be done before applying for RGI.

Price No excess fees

£235Inc IPT

More details Please note, I try my best to keep the information of each service up-to-date, but you should read the T&C's from their website for the most up-to-date and accurate information.

Usually, to qualify for RGI, your tenant will need a guarantor and they both would need to have passed or will need to pass credit checks.

RGI is generally designed to protect landlords against “bad tenants” that fall into rent arrears, so that means claims against tenants that lose their job or take a reduction in hours (either due to less work being available or self-isolation) could be denied. However, while it’s likely that many will be financially impacted by coronavirus, that doesn’t have to be the exclusive reason for rent arrears.

I don’t really understand how and where the underwriters will draw the line, because someone that falls into arrears is technically a “bad tenant” for any landlord.

In any case, I personally opted for RGI on the basis that it *might* cover me if my tenant loses their job, and then refuses (or can’t) pay rent. Many tenants seem to miraculously go radio silent when they fall into arrears, so we usually don’t even know ‘why’ it’s happened, we just know it has. Again, I have no idea on what basis an underwriter could refute that claim. Although, I’m sure they’ll manage somehow. They often do.

RGI is not a bullet-proof solution, but I think it’s relatively cheap enough to make sense. However, I think it’s much more important to have your finances/cashflow in order. However, RGI does increase the chances of recovering losses for relatively little money, in my opinion. “Speed trumps perfection”, innit?

I’ve successfully made claims in the past.

If you do grab a policy or twenty, please ensure every detail on each policy is accurate so your claims can’t be rejected. If there is ANYTHING you are unsure about (e.g. what you can and can’t claim for), contact the policy provider, and if needs be, get them to provide you with written confirmation of details that could get scrutinised in the future.

3) Talk to your mortgage lender

If you’re particularly concerned, which I imagine some of you will be, I recommend finding out if your lender has put any emergency measures in place. Some are offering ‘mortgage holidays’ and additional breaks and support for those facing financial difficulties.

If, for example, your tenant is financially impacted and has openly disclosed that they’re concerned about making rent, notify your lender immediately. Royal Bank of Scotland (RBS) and Natwest, among others, have said they will offer repayment deferral for up to three months. If you qualify, you can then pass on the savings to your tenant by temporarily reducing rent. If your cold, black heart wants, that is.

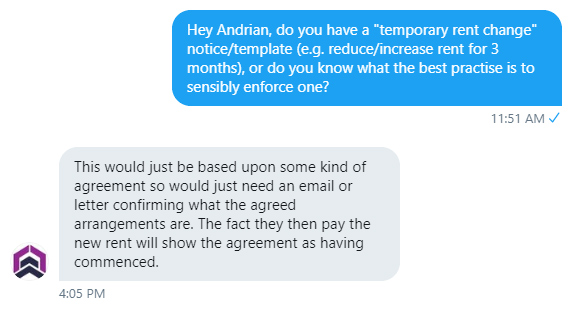

4) Temporary rent change

Part of minimising the damage to cash flow may include temporarily reducing your tenant’s rent. Under these circumstances, it’s likely that landlords could end up lowering rates for those hit by financial losses, whether it be on the basis of a gifted discount, or a debt to be repaid in the future.

I reached out to the super helpful and knowledgeable Adrian from the Guild of Residential Landlords, and asked him what the best way is to enforce a temporary rent change. Here’s what he had to say:

*slaps forehead* I called him Andrian!

He didn’t flinch, though. What a good sport.

If you amend the rent, make sure you send written notice, and specify how long it’s for. The concern here is that if the amendment isn’t properly documented, your tenant may runaway with the reduced rent amount indefinitely. Remember, people are scared, so they’re acting bloody nuts right now.

Update: some people have rightly asked what the implications of lowering the rent in regards to the tenancy deposit legislation, specifically because of the Tenant Fee Act, which limits landlords in England to take a maximum of 5 weeks’ worth of rent for the deposit. Annoying.

Honestly, I don’t know how lowering the rent will conflict with the deposit legislation, but because this is such an unprecedented scenario, I can’t imagine anyone will suffer from legal implications for lowering the rent to help tenants that have fallen victim financially due to the coronavirus (or any other circumstance). It would be absurd if they did! But obviously that’s just my hunch.

I personally would not hesitate, but I would make sure I get written proof from the tenant that they have been impacted by loss of earnings, and as said, document any new arrangements.

It might also be worth seeking advice from the tenancy deposit scheme you have secured the deposit with.

5) Allow tenancies to become periodic

I actually always allow my tenancies to roll onto a periodic agreement and I leave them that way until the end of time. I prefer the flexibility, it’s beautiful.

If you prefer choking and locking down your tenants for security purposes, I would personally hold-fire until the economy is revived and stable.

6) Maximum 6 month period for new tenancies

If you’re in the process of starting a new AST, consider making the fixed term for the minimum amount permitted, which is 6 months. Again, this is normal practice for me. I can’t remember the last time I dished out a 6+ month tenancy to a stranger.

7) Hold onto imperfect tenants, for now

In times of difficulty we often have to make sacrifices and decisions that aren’t ideal.

I’m not necessarily saying hold onto diabolically evil tenants, but I am saying that if you face a situation whereby you’re considering serving notice to your tenant because of their marginal misconduct (e.g. if they called your Nan a hairy-back Mary), you may want to consider whether 1) trying to find replacement tenants right now will be fruitful 2) whether you can grin and bear the displeasure for a tad longer.

Suffice to say, I know how soul-destroying dip-shit tenants can be, and on occasions I would have preferred to grapple with large void periods and cough up the associated expenses, rather than deal with their crap for a second longer. But that’s not usually a financially viable option.

It seems logical to me that people will be more inclined to stay put for now, which means less movement, and that will impact the rate of new tenancy enquiries. That’s something to bear in mind, definitely.

Again, exercise common sense with this one, dummy.

8) If you’re currently looking for new tenants!

Sheeesh kebab-me-in-the-ass, talk about mother of bad timing. I feel for you.

If you’re finding it tough, under no circumstances take any shortcuts out of desperation. Stay true to a vigilant and thorough referencing process. Even in times of crisis there are opportunists out there looking to take advantage of nervous landlords.

These are the same mules walking out of shops with sacks full of hand sanitisers so they can flog them on ebay and street corners for stupid money.

Ironically, “GET A REAL JOB, ASSHOLE”

Ahhh, how many landlords have heard that before? Classic.

Do not allow a rodent to slip through the net. Drug dealers are still dealing, and looters are still looting, and I’m sure there are scumbags out there diluting bottles of sanitizer with donkey piss to increase profit margins.

You may, however, want to consider slightly lowering your asking price to help boost interest. Remember, it’s usually always more cost-effective to reduce the asking price if it helps speed up the process, as opposed to leaving the property vacant for prolonged periods of time before eventually getting the full asking price.

Update: if you’re stuck in this unpleasant little boat, I’ve thrown a blog post together on how I would find tenants during the coronavirus lockdown. I hope it helps.

9) If your tenant is due to leave soon!

If your tenant is scheduled to leave in the coming weeks or even months, I would get in touch with them to find out if they still plan on vacating.

If they are, you may want to encourage them to remain longer due to the circumstances (if you want them to stay on, that is). You could consider cutting them a deal if you think it’s necessary, or mentally torment them by reminding them how dangerous it is out there at the moment. Don’t forget to document any arrangements.

I’m sure with all the fear and self-isolating, plans are changing all over the shop.

10) The cost of vacant properties

This definitely isn’t a rule of thumb by any stretch, but it’s worth keeping in mind that trying to help affected tenants remain in situ might be cheaper in the longer run:

- As already covered, the market might be less active right now, but also;

- there are costs associated to finding new tenants;

- most building insurance policies will not cover properties that remain vacant for 30+ days unless a separate unoccupied home insurance policy is taken out;

- the landlord will be liable for the council tax during the vacant period. Some local councils do offer discounts and exemption during vacant periods, but it’s becoming less common. You should contact your local council to find out if your property is entitled to any breaks.

11) Holiday/Short-let/Airbnb tenancies!

I didn’t originally contemplate the devastation the coronavirus would have on the short-let market, my head was too far up my own ass, focusing purely on regular ASTs. But thanks to a comment from Owen (comment #5), I was reminded and enlightened.

Since most short-let/airbnb lets are occupied by holiday-makers, it’s the end of the market that’s feeling the immense force of the pandemic right now.

Owen, who has a short-let holiday home, is contemplating the idea of converting his property into a regular AST and renting it out at below cost.

I think that’s a sensible plan worth considering since I don’t see the tourism and travel industry recovering anytime soon.

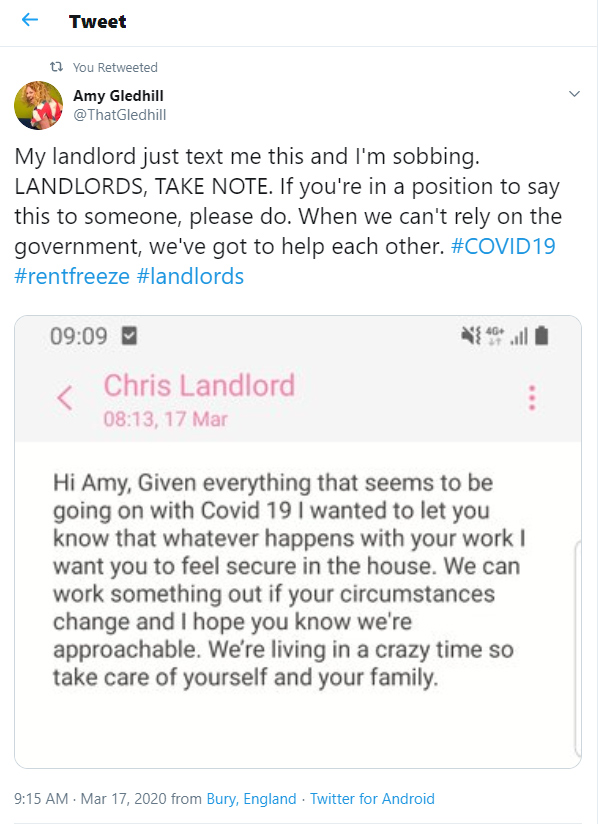

12) Reassure your tenants, perhaps

If you have nice tenants…

My only concern is, encouraging arrears and discounts. I don’t think we should be doing that, only assisting those in turmoil. I could only send out a message of that nature to the tenants that I can trust not to abuse the sentiment. Reach out to the wrong type of person and you’ll get pushed over a cliff. So careful on the trigger, cowboy/girl!

In any case, clearly wonderful and greatful individuals.

Other than that, I’m sure the government will introduce further measures in due time to assist with the financial woes, at which point I’ll do my utmost to keep you updated.

Just to be clear, I’m not advising anyone on how lenient they should or shouldn’t be as a landlord, I’m just covering a few likely scenarios, and looking at every situation objectively and brainstorming precautions and solutions. I know some of you gagged and vomited at the thought of lowering rent and offering discounts, ’cause presumably the fuel for your Range Rovers’ won’t pay for itself, virus or no virus. Relax, believe you me, I understand. My Cuban cigar tray is due a refill.

You may or may not be able to relate or agree with any of my thoughts, which is fine. The main objective is to encourage everyone to plan accordingly and put into place their own defences.

What if your tenant can’t pay rent because of the coronavirus?

First and foremost, as I said, talk to your mortgage lender to find out if they will temporarily defer your payments.

Beyond that, this is a tough one, and there is no right answer. At least, I can’t offer you one.

On one [sanitised] hand, self-preservation is important, so we still need to practise pragmatism and consider what’s best for ourselves. On the other [sanitised] hand, we’re in this together, and it’s in moments like these that acts of kindness are essential.

What I will say is the following (which isn’t exclusive to coronavirus victims, it’s based on nothing other than my own personal moral and ethical beliefs, which I wouldn’t dare enforce upon you):

- As always, try to be empathetic and help how you can, but don’t put yourself in a dire position by doing so.

Compromising your own position financially to help others may seem noble on the surface, but the reality is, it’s only multiplying the problem. That’s why I’ve never understood the irrational and critical backlash landlords receive from the public when we evict tenants that are facing hardship. Apparently, in their futile minds, it’s better to have two people struggling financially than one.

Shit-for-brains.

Yes, there are plenty of horror stories of brutal landlords mistreating tenants, but equally, there isn’t a shortage of stories about landlords being far too lenient and getting financially demolished by piss-taking tenants either.

Do what you can to help, no more.

- Not only is it our tenant’s responsibility to pay rent, but it’s also our responsibility, as landlords, to be stable and organised, so we can help our tenant’s endure their tough times (to a certain degree).

Now back to you. Are you concerned, and have you taken any extra precautions due to coronavirus?

Finally, I want to share the same sentiments as per my recent newsletters, and that is to wish you and all your loved ones’ good health!

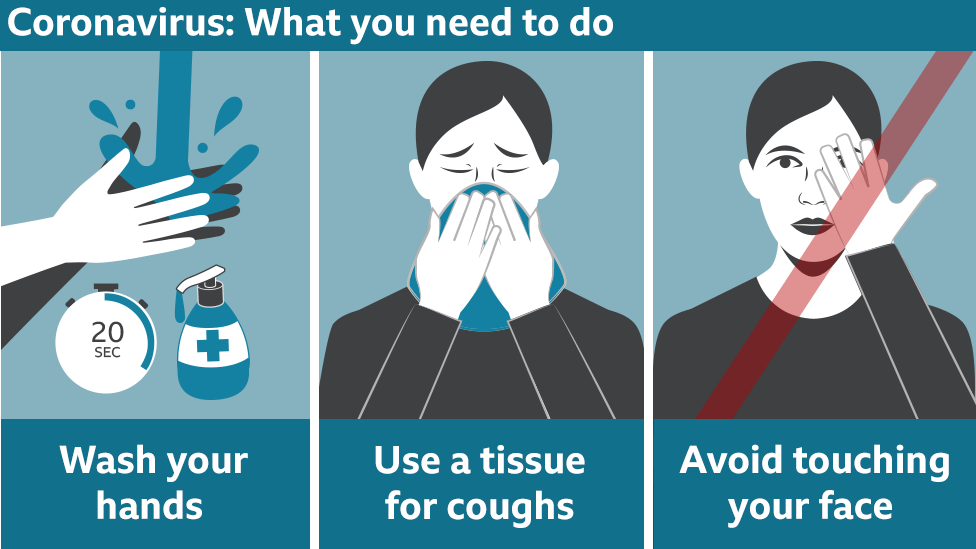

Please remain rational, safe, sterile, and securely cover your dirty little piehole when coughing or sneezing in public xo

Disclaimer: I'm just a landlord blogger; I'm 100% not qualified to give legal or financial advice. I'm a doofus. Any information I share is my unqualified opinion, and should never be construed as professional legal or financial advice. You should definitely get advice from a qualified professional for any legal or financial matters. For more information, please read my full disclaimer.

Landlord Products / Services

Landlord Products / Services

@ARO

I believe you can get RGI for HMO's, but I didn't specifically look into them (I don't have any HMOs).

I would just call a RGI supplier and see what they have available.

If you decide to do that, please let me know how you get on!