Oh, this is going to be fun!

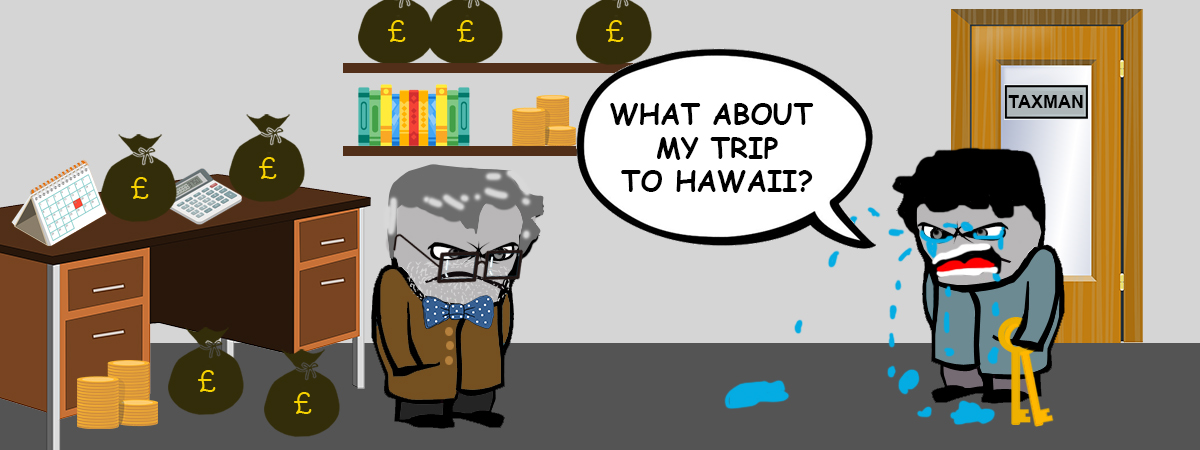

Let’s talk taxes! Specifically, expenses landlords can offset against their nasty tax liability. ZZZZZZZZzzzzZZ!

I know, I know, no one wants to be here, but we’re here because paying taxes is a necessary evil, so while there’s no escaping it, we may as well do what we can to minimise the trauma!

Sadly, many landlords end up with larger tax liabilities than necessary, simply because they don’t take full advantage of their allowable expenses.

Before kicking off, here are a few handy and important disclaimers that you should be aware:

- Legal disclaimer

You know the drill.This blog post is for general guidance only, so none of the information should be construed as advice. I’m not an accountant or financial professional by any stretch (I’m just a landlord), so you should always seek professional tax advice before making any decisions.

- The limitations of my checklist

- While my list is pretty extensive (if I do say myself), it isn’t exhaustive. So if you suspect you have a deductible expense that’s not listed, it doesn’t necessarily mean it’s not.

- If your rental business is operating under a registered company, then you’ll be entitled to additional deductible expenses (e.g. interest on business loans), in which case I highly recommend getting professional advice.

We cool? Excellent. Let’s do this…

Landlord Tax Deductible Expenses

Accountancy

- Financial advice

- Accountancy fees

- Bookkeeping fees

- Accountancy Software

Education & Support

- Landlord Associations

- Training costs

- Seminars

- Courses / workshops (e.g. tax planning, compliance, ending tenancies etc.)

- Books

Healthy & Safety

- Electrical safety certificates

- Gas safety certificates

- Smoke and C02 alarms

- Legionnaire tests

Insurance & Service charges

- Landlord licences (if applicable)

- Building insurance

- Rent guarantee insurance

- Public liability insurance

- Contents insurance

- Ground rents where applicable

- Council tax (if paid by landlord)

- Utility bills e.g. gas, electricity, water etc. (if paid by landlord)

Legal & Paperwork

- Solicitor fees

- Legal fees (e.g. evictions and disputes)

- Debt collection fees

- Document fees (e.g. eviction notices, tenancy contracts)

Office

- Telephone costs (of your business landline or business mobile)

- Stationary costs

- Internet costs

- Computer equipment if it is used solely for business purposes

Lettings, Advertising & Marketing

- Lettings & management fees

- Rent collection services

- The cost of hosting and maintaining a website

- The cost of any advertising (e.g. online, newspapers etc)

- Property photography

Transport & Travel

- Inspection visits

- Visiting the letting agent

- Viewings

- Accountant visits

- Solicitor visits

- Property maintenance visits

Repairs & Maintenance

- Property repairs

- General maintenance

- Cleaning services

- Labour

- General maintenance – like for like repairs and replacements

- Tools and materials required to assist with maintenance

- Removal costs

- Skip hire

Furnishings

- Any moveable furniture, like tables, wardrobes, shelves, bookcases, etc.

- Furnishings e.g. carpets, mirrors, lamps, curtains

- Household appliances e.g. white goods, TVs and other electrical items

- Kitchenware e.g. crockery and cutlery

- Furniture restoration/repairs

- Furniture replacement (must be like-for-like and not “betterment”)

Expenses landlords cannot claim a deduction for

The following is mostly snatched directly from the GOV website (so don’t shoot the messenger):

- Private telephone calls

- Clothing – for example, if you bought a suit to wear to a meeting relating to your property rental business

- Personal expenses – you cannot claim for any expense that was not incurred solely for your property rental business

- Allowable expenses do not include “capital expenditure”:

- add something to the property that was not there before

- alter, improve or upgrade something that was existing

- include the purchase of furnishings and equipment for the property

Capital expenses are not allowable and cannot be claimed against your rental income but you should keep records of them as you might be able to set them against Capital Gains Tax if you sell the property in the future. Examples of capital expenses:

- adding an extension

- installing a security system if there was not one before

- replacing a kitchen with one of a higher specification

- Wear and tear

- “Finance costs” – after the introduction of Section 24 – and after it fully rolled out in 2021 – landlords can no longer offset any finance costs against their tax liability. That includes interest on any loans (e.g. mortgages, overdrafts etc) and any associated fees (e.g. arrangement fees).

Save all your receipts and account for every single penny spent on your rental property, even puny items like a pack of nails. Every penny adds up and an accumulation can even push down your tax band.

It’s also worth noting that I was recently advised by a specialist tax account that the biggest mistake landlords make when doing their accounts is not keeping detailed records of their income and expenditure. HMRC have the power to call upon records in the event of an enquiry and penalties can arise if supporting evidence is not made available.

Capital Expenses (“betterment”) explained

The lord knows I don’t want to keep here longer than necessary (because this is topic is mortifying enough), so believe me when I say that it’s important to know what “Capital Expenses” are in order to get a better understanding of what is a taxable expense for landlords. Fortunately it’s simple enough to understand, but it’s a rule that many landlords are oblivious to.

I already briefly touched on “capital expenses”, but I didn’t really explain it.

In short, a capital expense (also referred to as “betterment”) is an expense that increases your capital. In other words, anything that increases the value of your property (e.g. extensions, renovations). Capital expenses are NOT tax deductible.

This also applies to repairs/replacing items. For example, you can only deduct up to the value of a like for like replacement, so if you replace or upgrade an item that adds value to the property, it could be classed as betterment. There are very few exceptions, of course. For example, even though replacing single glazing windows with double glazing is technically “betterment”, it is seen as incidental, because the single glazed window is being replaced with the nearest modern equivalent.

Okay, time to put you out of your misery and cut the feed.

I hope the list has been useful and given you a sense of what can and can’t used as a deductible tax expense.

Landlord out xo

Disclaimer: I'm just a landlord blogger; I'm 100% not qualified to give legal or financial advice. I'm a doofus. Any information I share is my unqualified opinion, and should never be construed as professional legal or financial advice. You should definitely get advice from a qualified professional for any legal or financial matters. For more information, please read my full disclaimer.

Landlord Products / Services

Landlord Products / Services

The biggest area is claiming expenses against training. People think just because they have been on a course it is tax deductible when in all likelihood it may not be. Surely a business has to be running first as the course has to be exclusively for the business and it has to build on your experience. Also the question is does your business need you to be trained - a landlord doesnt need to be trained. If you are a landlord and wish to expand into serviced accommodation then this is not adding to your current knowledge but it is another business. If you are able to clarify this area of expenses Im sure it would be a great help.