Hi gang!

So, after watching yet another brazen ‘property guru’ shamelessly doing the rounds on social media, gleefully peddling their car-crash property course like they’re touting the cure for cancer, it dawned upon me that I’d love the opportunity to rip those blinding pearly white veneers straight out of their piehole.

But also (and this is the main point), I’ve seen enough of their sales pitches to realise that there seems to be either a severe case of clinical ignorance or, worse, wilful misguidance from these folk when it comes to the distinction between the price and value of an investment. It matters. A lot.

It’s always about house prices reaching astronomical levels, never about value.

Anyone that has chosen to take the goofy path of flogging property courses for a living – while self-proclaiming to be a “self-made property millionaire” (which is all of them) – really should know better, but for everyone else that is in the dark, I take on the challenge with zero condescending undertones, because in all honesty, I learned this stuff later than I should have.

Many of us already understand that inflation signifies an increase in the cost of living, but as landlords (and homeowners), understanding how and why it impacts the value and price of our assets can be life-changing.

Shall we? Let’s…

BTW, what an absolute shit-show! I overestimated my abilities by, like, infinity.

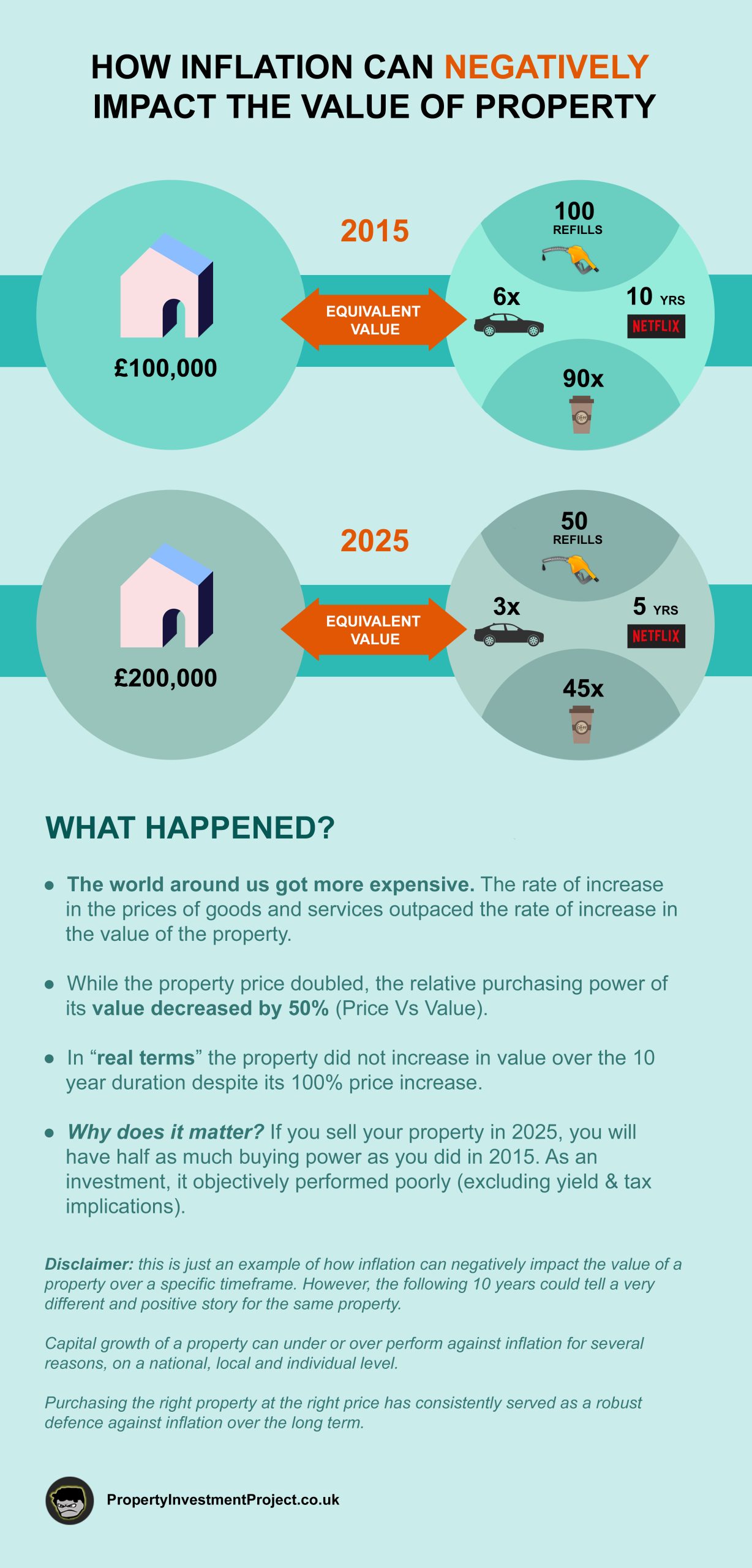

I carved out 30 – 45 mins of my morning to brainstorm and execute an infographic, to help make it super easy for any dummy to understand how inflation impacts the value of a property (and more importantly, why it matters).

This piece of crap ended up taking me all wanking day.

Mum is right, I am disappointing. Right now I feel like I am that person that would come out sucking my own thumb if I fell into a barrel of boobs.

Anyways. I got there eventually. So let’s marvel at the fruits of my labour. Anything less, and I may just cannonball myself out of the ground floor window onto an extra absorbent crash mat (it’s about making a statement, not inflicting physical pain on the merchandise).

(Did I mention it took me all bloody day?)

The litmus test was running the infographic by my 12 yr old nincompoop nephew.

After glancing one eyeball over it (while the other was glued to an iPad), he assured me he gets it. Bear in mind, this is the same kid that spends his spare time trying to optimise how moist he can get his index finger with his own saliva before attempting to shove it in his little brother’s ear, screaming “wet willy”

So if he actually gets it, I’m going to go ahead and give myself a pat on the back.

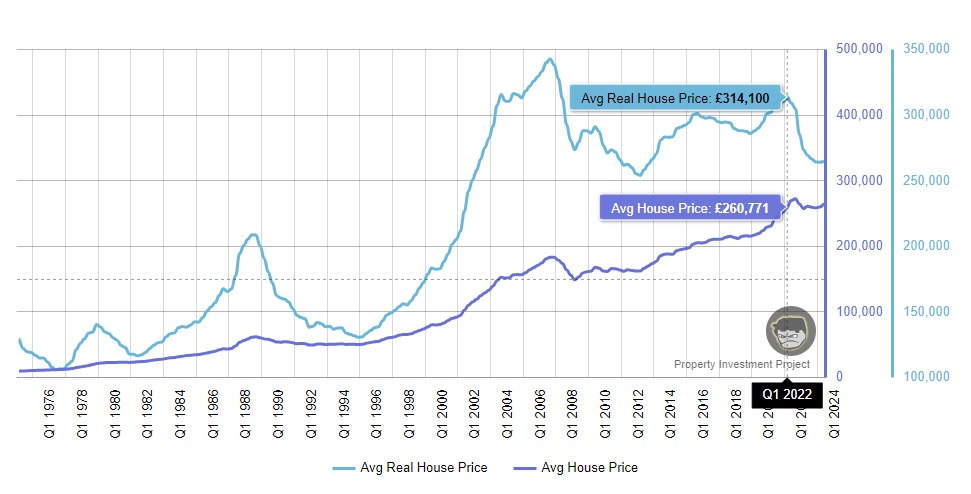

House Prices Vs House Prices Adjusted for Inflation (“Real House Prices”)

Anyone that has encountered a respectable house price chart during their travels will have been briefed on the way in, on whether they’re looking at house prices adjusted for inflation or not.

When the data is adjusted for inflation, it provides the real value of houses, by factoring in the influence of inflation. If the data is not adjusted, you’re getting the average prices at which houses were bought and sold (and not their true value).

Here’s how it works:

- Firstly, house price data is collected, reflecting the average prices houses were purchased and sold for during specific periods.

- To calculate the inflation-adjusted values, the inflation rate for each period is subtracted from the corresponding average house price. For example, if the inflation rate in 2015 was 2% (average), £200,000 would be adjusted downwards by 2% to reflect its real purchasing power.

- £200,000 adjusted for a 2% decrease due to inflation would be:

£200,000 * 0.98 = £196,000.

So while a [nominal] house price chart might indicate that the average cost of a house in 2015 was £200,000, the corresponding value on a chart adjusted for inflation would be £196,000.

It can get frightening when assessing the value of houses depending on specific timeframes and acquisitions, particularly during the past two decades…

Source: UK Real House Prices Adjusted For Inflation

For example, the graph shows that in 2022 Q1, the average property price was £260,771. However, to purchase the equivalent amount of ‘retail goods’ in 2024 Q1 (based on the Retail Price Index, RPI), it would require £314,100. In other words, the purchasing power has decreased because it now takes more money (£314,100) in 2024 Q1 to purchase the same amount of ‘retail goods’ that could have been purchased for £260,771 in 2022 Q1.

You can run the calculation using this RPI calculator.

Don’t worry, I’m going to sprinkle some joy on this sinking turd soon (I intentionally picked a gut-wrenching example)!

What key points can we take away with this information as property investors?

Hopefully I’ve made a compelling (and easily digestible) case for why it’s useful (albeit, potentially a total snooze fest. I get it!) for investors to understand inflation, property prices and values, and how it all ties together.

Now, here are a few thoughts on how to apply this knowledge to practise (obviously not financial advice, just thoughts off the top of the dome on how it could be leveraged)…

- Price matters when buying, value matters more when selling.

- Return on investment Vs fiction – I’ve seen several property influencers base their sales pitch on property prices doubling every 10 years – they use it as a hook to lure in the punters, and it’s certainly very compelling. While prices may have historically doubled in 10 year cycles, it’s actually – for reasons explained – an arbitrary metric with very little meaning by itself from an investment standpoint.

What if property prices doubled in price while jam doughnuts have multiplied by a billion?

In the past 10 years, on a nationwide scale, many properties have not doubled in value against other goods and services (including jam doughnuts, probably). Not even close. Not saying properties haven’t outperformed or even remained in-line with inflation (I think either outcome is winning, personally), they have, but equally, many properties all over the country, especially in certain London boroughs, have lost value in “real terms” even though prices have spiked.

So, it may not always be wise to plan an exit strategy based on historical house price data, and secondly, it’s important to be realistic about expected returns (which can still be great).

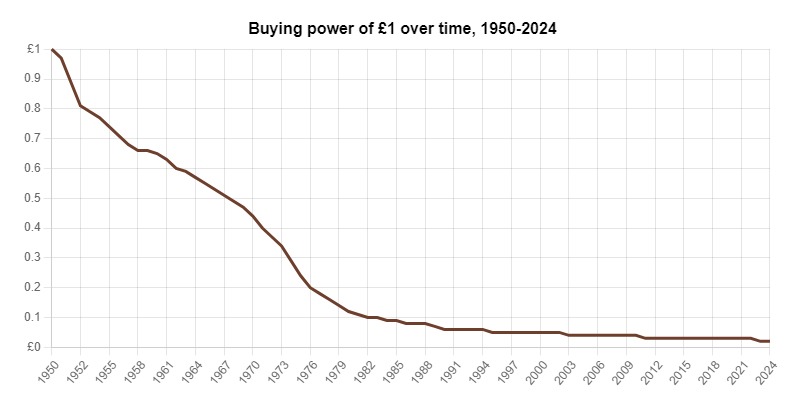

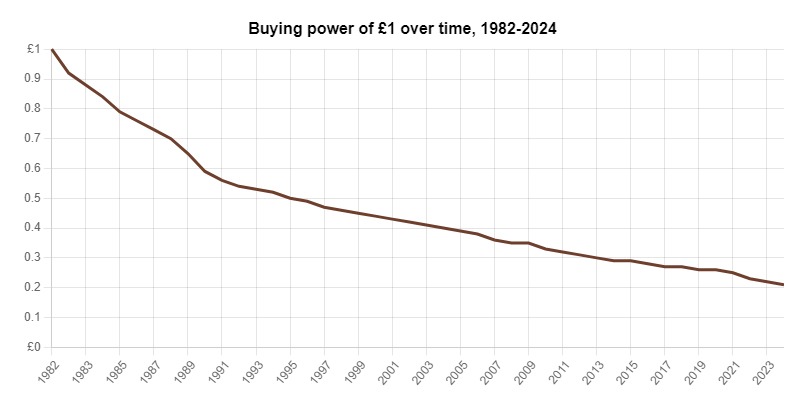

- Property can recover, GBP cannot! This is exactly why we’re in the game and why investing in property is beautiful compared to hoarding vast sums of cash.

Inflation is a fundamental feature of most monetary systems. Consequently, the pound sterling, along with almost every other fiat currency on the planet, is losing value over time. This reality is made clear by the 2% annual inflation rate target set by central banks. Unless our income keeps up with inflation, we’re effectively getting poorer every year. This is real for many people today, as inflation has been rampant and salaries and financial aid have been stagnant, hence the “cost-of-living crisis“.

(side note: from what I’m aware, the 2% is another arbitrary number. No one can explain why it’s 2%. Moreover, it’s often not met. It’s just pointless!).

Exhibit A: the destruction of GBP.

Source: officialdata.org

That’s just pitiful.

If you found your silver-lining in the stability that appears to occur after 1982, I’m sorry…

Perspective is everything.

Fortunately we’re not bound by our hard-earned and useless GBP; we can invest it into appreciating assets like property, where graphy goes up! The bugger [property] is resilient too; even if its value plateaus or jumps off a cliff, it has the potential to bounce back, and usually does. While full recovery isn’t guaranteed, there’s nothing in the genetic code preventing it.

Moreover, we have direct influence over its value, irrespective of economic conditions. For instance, by adding a £29.99 extension, we can potentially increase the property’s value by £39.99.

Some people have referred to the widespread decline in property value in real terms as “the silent property crash.” Personally, I think the real crash is occurring with our local currency, the proof is evident, and it’s making much less of a racket on the way down.

So what does this ultimately mean? I believe I’m better off leaving my money parked in property for the long-term rather than holding cash; my wealth will be better preserved that way.

Stock traders often say that you’re not in a losing trade if you don’t realise your losses. In other words, you’re not a loser unless you sell at a loss. The same very much applies with property investments.

- Cashing out on a high! Knowing that property can fluctuate in value, we’re able to time when we sell (if we have that luxury) for optimal returns.

As the well-known adage goes, sell on the way up, buy on the way down.

Of course, from an investment standpoint, it’s counterintuitive to cash out on a high and sit on lumps of cash (because the process of dying slowly by a thousand inflation cuts starts immediately), but if the plan is to splash the cash or allocate the capital into other investments, happy days.

- BTL generates yield! Thank God for rental income (which moves with inflation, and effectively erodes mortgage debt!), because even if we’ve been let down by capital growth, we can always make up ground with yield.

- Buy the right property for the right price! Hi, it’s me, Captain Obvious! *waves*

No, but seriously! The reason the property in my infographic may have underperformed is simply that it wasn’t a good investment from the offset, perhaps due to its location, property type, or whatever else.

Even if properties are depreciating in “real terms” nationwide, your investment doesn’t have to follow the trend; obviously buying the right property at the right price helps.

The primary objective of this blog post is to highlight the difference between value and price, and how inflation impacts both – no more, no less.

If you sell your property for more than you purchased it, and you’ve managed to cover your costs with capital appreciation and/or yield (i.e. rental income), then you’re ultimately ‘cash wealthier‘ and better off than if you had just sat on that initial cash investment and done nothing with it. Congrats.

(disclaimer: I’ve intentionally made no account for tax implications, because I simply wanted to highlight Price Vs Value. Tax liability is something you will definitely need to evaluate, as it can change the entire landscape of your investment and decisions!)

How inflation is measured and problems with accuracy

UK inflation is measured by the Office for National Statistics using three different indexes, all tracking the changes in price of hundreds of things that people regularly buy, including everyday things like a loaf of bread and a bus ticket. It also includes much larger ones, like a car and a holiday. The point is, the indexes tell us whether life is becoming more expensive or cheaper.

- Consumer Price Index (CPI) – measures the changes in prices of a fixed basket of goods and services that represent what the average consumer purchases regularly. While it covers a wide range of expenses, it does not directly include housing costs like mortgage interest payments, council tax, and other housing-related expenses.

CPI is the “headline” measure of inflation, which means it’s the most widely reported and commonly used measure of inflation. In other words, it’s the main number that people and policymakers pay attention to when discussing inflation i.e. when you hear the inflation rate being discussed, it’s usually referring to the CPI.

- Consumer Prices Index with Housing (CPIH) – measures the same as CPI, but includes housing-related costs, specifically the costs that homeowners deal with (e.g. mortgage interest payments, council tax, maintenance etc).

CPIH is likely to be better suited for us homeowners, and it should come as no surprise that it’s recently been printing [significantly] higher rates than CPI (Mar 2024: CPI: 3.2%, CPIH: 3.8%).

CPI being the headline rate certainly works out nicely for the Government, doesn’t it?

- Retail Price Index (RPI) – introduced in 1947, this was the official headline consumer price inflation measure before CPI came along and stole the spotlight. From what I’m aware, it got replaced because it uses a methodology that is no longer reflective of modern economic conditions. However, it is similar to CPIH in the sense that it also includes housing costs.

Even though RPI isn’t used as widely to measure inflation these days, I’ve noticed that some house price indexes still use it to calculate “real house prices” (e.g. Nationwide). That’s most likely the case because of the availability of historical data that CPI/CPIH doesn’t have, along with the inclusion of housing costs in its calculation, which remains significant for certain analyses, notably in the housing sector.

Alas, the baskets of crap probably isn’t an accurate reflection of what you and I buy on a day-to-day basis. Simply, their basket isn’t my basket.

At the time of writing this blog post (March 2024), and as already mentioned, CPI is 3.2% (CPIH is 3.8%). That obviously seems like a sick joke, because I know for a fact that my like-for-like spending has increased by considerably more compared to last year. I suspect yours has also. I wouldn’t feel nauseous every time I make a trip to my local supermarket if I was only contending with a 3.2% hike. Anyone else noticed the brutally sickening price of olive oil lately? Hello?

I don’t ‘spose they have my hairdresser’s rates in any of their baskets? That little rat-weasel went renegade and bumped his prices by 20%. Apparently due to some mumbo-jumbo about the rising cost of energy.

So what does this mean? Probably that our investments should not only beat inflation, but beat it by a significant margin in an ideal world (especially to absorb taxation on capital gains).

How to run your own calculations (to see if your investment is currently beating inflation)

- Bank of England’s CPI inflation calculator – retrieves data directly from CPI provided by the Office for National Statistics. It’s useful for assessing the real return on investment (ROI) for property investments and other appreciating assets.

- Office for National Statistics CPIH inflation calculator – this uses CPIH data, so it includes the costs associated with owning, maintaining and living a house, providing a more comprehensive means to gauge your personal inflation rate.

This tool prompts users to manually input their expenditure across various categories such as food, energy bills, and travel expenses, offering a clearer picture of the inflation’s impact on individual finances.

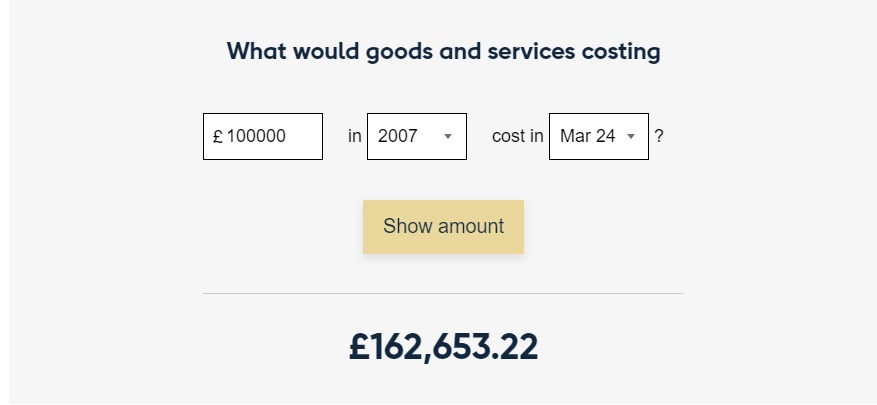

Here’s a screenshot of the Bank Of England’s CPI calculator:

What is the result telling me? If I purchased a property in 2007 for £100,000 it should be valued at £162,653.22+ in order to be outpacing inflation. Anything less, and it’s lost value to the outside world.

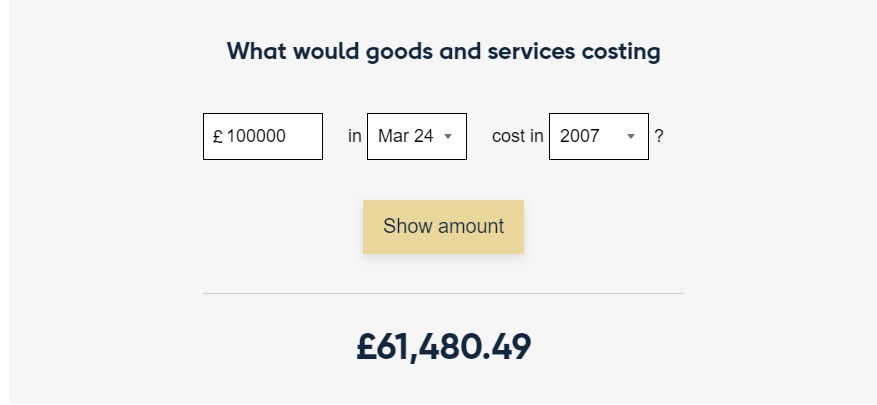

But bear in mind, If I had deposited £100,000 into a bank account in 2007, its purchasing power would have eroded to the equivalent of £61,480.49 today (not accounting for any interest earned).

And there’s your sprinkle of joy! The real mugs are the people holding onto large bags of cash instead of investing.

That graphic thingy really did take me all day, ya know? I just need one angel to tell me they gained something valuable from it, and I’m certain it will make it feel all worthwhile! Failing that, at least tell me I picked nice colours, Christ.

Landlord out xo

Disclaimer: I'm just a landlord blogger; I'm 100% not qualified to give legal or financial advice. I'm a doofus. Any information I share is my unqualified opinion, and should never be construed as professional legal or financial advice. You should definitely get advice from a qualified professional for any legal or financial matters. For more information, please read my full disclaimer.

Landlord Products / Services

Landlord Products / Services

Nice colours in the infographic! :-)

Seriously - great post! Thank you!