According to Zoopla’s research, it takes an average of 50 days to sell a property in the UK.

But what if that’s just not fast enough, or what if your property isn’t shifting at the average rate?

There’s a variety of reasons why someone may need to sell a house fast, from divorce and bereavement to avoiding repossession. They may have found their ideal home and don’t want to risk losing it, or they may just want to get moving sooner rather than later.

Ultimately, your reason doesn’t matter, because this blog post is about the options you have available if you’re looking to sell fast.

4 Options to selling your house fast!

Each option has its own set of advantages and disadvantages, and depending on your motive and specific set of circumstances, it’s likely that some will be better suited than the others.

- 1) Sell to ‘cash house buying’ company

- 2) Use multiple estate agents

- 3) Lower asking price

- 4) Sell at auction

1) Sell to ‘cash house buying’ company

Also commonly known as a “We buy any house” company.

To be honest, this is the only option that will 100% guarantee a quick sale and the money in your bank account, which is precisely why it’s ranked #1 on the list.

If you’re in need to sell your house as quickly as humanly possible, this is most likely your best option. Most cash buyer companies will buy any house, in any condition, so you don’t have to spend time or money on repairs. They can also buy your house in as little as seven days, or any other timescale you need to fit with your plans. With the best cash house buying companies the sale and the price are guaranteed, giving you a confidence you simply don’t get from other sales methods.

Of course, there’s a price to pay for the convenience…

A cash house buyer is a business, just like any other. They will usually offer around 80 – 85% of the market value of your home. That might sound a lot, but remember, by selling a house fast to a cash buyer you’ll have no costs to prepare your home, no estate agent fees to pay, and most companies will cover your legal fees too. Plus you won’t have to suffer the indignity of endless viewers, the heartbreak of failed sales and broken chains, or the agony of waiting for any kind of interest in a dead property market.

It’s an extremely popular option among sellers that are willing to take a hit if selling quickly is the primary objective.

Advantages

- They buy any house, in any condition, so you don’t have to spend time or money on repairs and redecoration.

- It’s the quickest and easiest way to sell your house quickly.

- It’s the only option that 100% guarantees a sale.

- Sales completed in as little as 7 days (and cash in your bank).

- No legal or agent fees, they take care of everything.

Disadvantages

- The “quick house sale” industry is unregulated, which means there isn’t a shortage of scammers operating, waiting to exploit vulnerable people in their hour of need. So it’s important to use a reputable cash house buying company.

- Expect to receive a cash offer of 80 – 85% of the market value!

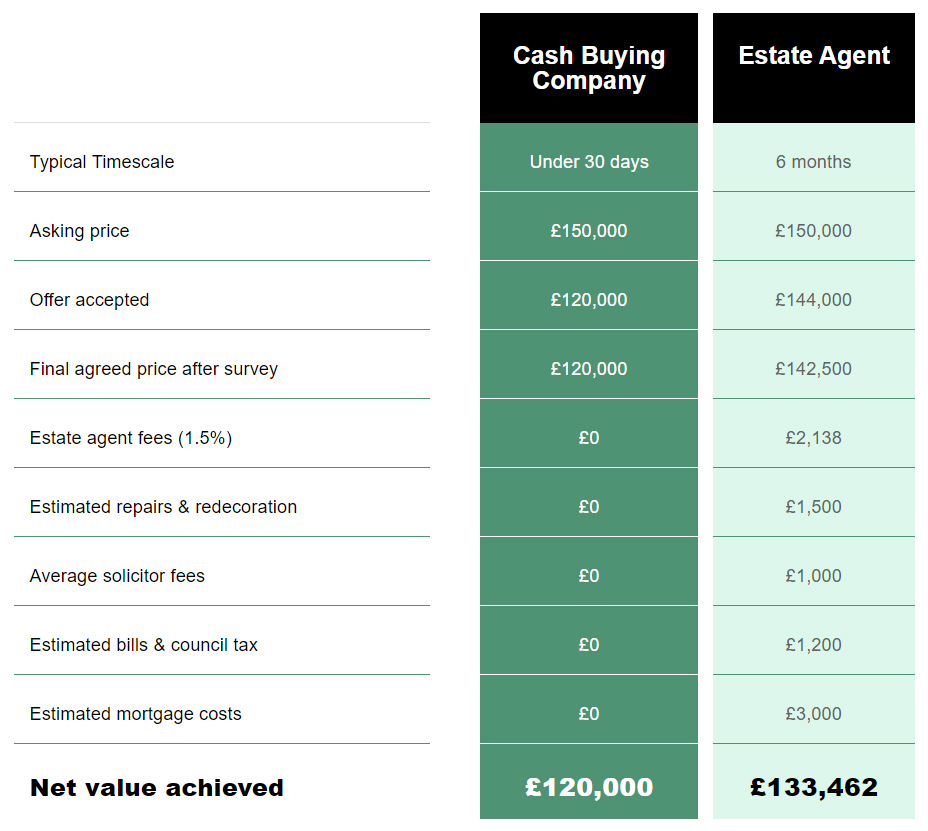

Here’s an example I found on a cash buying company’s website, which displays what you can expect in terms of costs/net value when comparing against a traditional high-street estate agent (that charges 1.5% commission), so make of it what you will…

If you want to find out more about these companies, you can find out more from my ‘quick cash home buyer’ company guide.

Expert Insight

My boy Kelvin is Buying Director of the cash buyer company MyHomebuyers.co.uk and works at the sharp end of the property market on a daily basis. Over the last ten years he has completed tens of millions of pounds worth of property deals, in markets fast and slow! Needless to say, he knows his shizzle, and he’s one of the good guys, so I reached out to him for his quick thoughts on when and why people should make use of services like his…

Selling to a cash buyer is not right for everyone.

For most people, waiting it out is the name of the game. Homes are always selling, even if we’re in a period when they are selling slower and for less. Unless you absolutely need to sell fast, your best bet is to just be patient and wait for a buyer to come along.

However, if you do need to sell a house fast for personal or financial reasons, then selling your house fast to a cash buyer can be the quickest option available to you.

Kelvin Elliott, purchasing director of MyHomebuyers.co.uk

2) Use multiple estate agents

I know what you might be thinking. Is using an estate agent really an effective means of selling a property fast?

The answer to that is, an unsurprising not really!

However, when you throw multiple estate agents into the equation – all fighting it out at the same time to beg you a call (so they can earn some of that sweet commission) – then we’re dealing with an entirely different animal, known as a multi-agency strategy. Not only is this approach optimal for speed, but also for achieving higher sale prices (which is contrary to the other methods listed).

While using a multi-agency strategy is not the quickest of all solutions, it definitely is most likely going to be the quickest method of achieving a sale through a traditional open market sale via an estate agent. So if you’re not in an immediate rush to sell but after a quicker than average sale and/or if getting the highest sale price is your primary objective, then this is the best option, in my opinion.

Advantages

- Working with multiple agencies can attract more buyers, which can lead to quicker sales and higher offers.

- Out of all options, using a multi-agency strategy is the only one that doesn’t rely on selling for BMV. In fact, as said, it can lead to a higher sale price than initially anticipated.

- Competition between agents can make them work harder to get the sale.

- On average an estate agent will only sell 50% of the houses they market, so using multiple agents can significantly increase your chances of a sale.

Disadvantages

- If you’re currently contracted to an estate agent under a “sole agency” agreement, your agent will have to agree to switching to a multi-agency agreement before you’re allowed to task another agent.

- Estate agents charge more commission for a multi-agency agreement, because they’re having to work harder. Expect fees to be 2.5% – 3.5%+VAT of the sale price, as opposed to the average fee of 1.5% for a sole agency agreement.

- You’re still reliant on a traditional route to sale, so there’s no guarantee of a quick sale, or even a sale at all!

How to use multiple estate agents

You can, of course, do the obvious, which is to approach local agents and agree to and sign a multi-agency agreement (so that means you’ll have to be upfront with them). However, as mentioned, you’ll likely be subject to a higher fee compared to using a sole agency agreement (which makes sense, since multiple agents will now be competing against one another to get the sale and earn their commission).

Alternatively, you can use a service like flyp’s (which I actually think is the better option).

In short, flyp does all the legwork to build a multi-agency strategy on the seller’s behalf. In practice, that means you sign an agreement with flyp directly (and not the agents), and they’ll find and recruit all the best local agents to market and sell your property, and flyp will manage the entire process on your behalf. You only deal with flyp, and not the agents.

The best part? Most of flyp’s customers pay between 1 – 1.5% of the sale price on fees, so you get a powerful multi-agency strategy for the price of a standard sole agency agreement. flyp takes 0.25% commission out of the agreed upon 1 – 1.5% sale price which is settled by the agent that gets the sale, so you don’t pay an extra bean!

| Service | Rating | Notes / Includes | |

|---|---|---|---|

Service | Rating TrustPilot Reviews | Notes / Includesflyp’s service is designed to help homeowners sell their property as quickly as possible while securing the highest price.

| Book FREE Appraisal |

For more information, visit flyp’s website directly, or my blog post on How To Sell Your House For The Most Money.

Traditionally, the best time to sell a property is during spring (particularly March), which means statistically you’re more likely to sell your house faster during that period. For obvious reasons, December and early January are dead zones.

3) Lower asking price

I suppose this is the most obvious option, and there’s very little to say. But say I will.

It’s important to understand that price is everything. Often homes that are stuck on the market for a long time have been overpriced by the estate agent. They tell people what they want to hear to win their business, but that can soon backfire when it fails to sell.

To sell a house fast (especially in the middle of a slow market) you need to make sure the price is competitive. Look at what other homes in your area have sold for, but make sure you check the actual selling price, not just the asking price.

Advantages

- Quick and easy to implement.

Disadvantages

- In a stagnant market, lowering your price may not have any impact.

- May cause financial issues if the original asking price was needed for other expenses (e.g. finance another property).

- It doesn’t guarantee a sale, let alone a quick one.

- You may need to drop your price a few times before it has any significant impact, and that might be counter-intuitive [because that process can take time].

There’s a chance that your asking price is not the culprit, but rather your agent is, so it might be worth changing your agent and/or using the multi-agent option before dropping your asking price.

4) Sell at auction

There are two types of auction to choose from:

- Traditional auctions are like the ones you see on TV. They take place on one day, with bidders in the room and a man with a hammer taking charge. Exchange happens on the day and completion must happen within 28 days.

- Modern auctions are more like eBay. They take place online and happen over four weeks or so. You then have 28 days to exchange and 28 days more to complete.

- When sell at auction you exchange straightaway with completion 28 days later – no ifs, buts or meddling with prices.

- You can set date of sale, which means you can plan better (e.g. if selling in a tax year or wanting to raise funds).

- 76% chance of sale on the day (historic auction success rate)

- You can claim back the cost of preparing the legal pack (e.g. searches etc) and in some cases some vendors request a contribution towards sale costs (typically 1-3%), which is detailed in the special conditions.

- Auctions are a good option if you have a property in need of work, tenanted or anything else that’s a bit unusual for the private treaty market.

- Auction buyers are well versed in the difficulties that can happen to properties and so auction is also a place to sell difficult properties!

- Likely get 80-90% of open market value (plus a fee of 2-3% + VAT commission on the sale), although if in an area of demand, there’s potential to exceed estate agent valuations, particularly if there’s plenty of competing bidders – but very much day dependent.

- Legal paperwork has to be prepared beforehand – at least 3 weeks before sale.

- There are no guarantees. As many as one in four homes will not sell at auction, either through lack of interest or because they didn’t meet their reserve price.

- Avoiding repossession – selling a house fast to avoid repossession will protect your credit score, and most people will usually get more for their property than repossession.

- Getting a clean break – if a relationship is going through a breakup or divorce, selling a house fast means both parties can sort out their finances and move on as quickly as possible.

- Accessing an inheritance – liquidating an inherited property to quickly access cash. This is often done when multiple people have inherited the property and just want the money.

- Fixing a broken chain – if a buyer pulls out of a deal, selling a house fast can repair the chain and keep everyone moving, so the seller doesn’t lose out on their dream house.

- Moving to a new job – relocating for a new job, new grandchildren or any other opportunity, selling a house fast can help make this happen.

- Dealing with a problem property – some problems, such as subsidence and septic tanks, make a property hard to sell, period. Selling a house to a cash buyer, or at auction, resolves the problem of having to deal with the stress of managing repairs or waiting for a buyer to come along that’s willing to buy the property.

Each one has its benefits and drawbacks. Some people think that traditional auctions are more competitive, with bidders in the same room driving up the price. But if you’ve ever bought anything on eBay, you’ll know how competitive online auctions can get, with bids going right up to the wire. Traditional auctions are faster, but modern auctions potentially reach a wider audience because they give you time to arrange a mortgage.

And now, I would like to introduce my friend, Sam Collett, the property auction mogul herself.

I reached out to her to see if she would be inclined to drop some knowledge. I literally gave the poor woman barely any context, I just kindly asked for the advantages and disadvantages of selling at auction (via a very informal and sloppy Twitter DM).

Expert Insight

Sam Collett is a serial landlord that amassed her portfolio through property auctions. She lives, breathes and writes property auction books.

Advantages

Disadvantages

Any final words Sam?

I have sold several properties at auction all for above reasons – timing, raising capital, difficult property. I’ve been happy for all occasions.

Auction fees for selling are similar to estate agents. Honestly, I’m surprised more people don’t sell at auction when you factor in all the hidden costs of what not selling can cost you!

If you want to know more about property auctions and/or Sam (which you should!), here’s a link to her nifty little blog, WhatSamSawToday.com.

So, there you have it. Four varying options on how you might be able to achieve that sale, pronto.

Why would you need to sell a house fast?

I know I said the why doesn’t matter, and I still stand by that, because the reality is, no one needs to justify why they want to sell their own property. However, I thought it might be helpful to highlight a few of the most common reasons for why people choose (or possibly need) to sell fast.

Disclaimer: I'm just a landlord blogger; I'm 100% not qualified to give legal or financial advice. I'm a doofus. Any information I share is my unqualified opinion, and should never be construed as professional legal or financial advice. You should definitely get advice from a qualified professional for any legal or financial matters. For more information, please read my full disclaimer.

Landlord Products / Services

Landlord Products / Services