I’m trying to be positive.

I really am!

But it’s becoming increasingly difficult.

The bog-roll bandits are still terrorising Tesco shelves with coordinated attacks. I literally have 2-3 days worth of supply left (depending on how much/little I eat), and then I’ll be forced to decimate and violate the leaves in my garden.

Yesterday (18th March 2020) the government announced, I quote, “radical package of measures to protect renters and landlords affected by coronavirus.”

And that, certainly did make me feel even more radically less than inspired.

I said I’ll do my utmost to keep you updated. So here we are.

Okay, so let’s take a look at this junk…

Here’s the official press release of the measures. They include:

- Emergency legislation to suspend new evictions from social or private rented accommodation while this national emergency is taking place.

- No new possession proceedings through applications to the court to start during the crisis.

- Landlords will also be protected as 3 month mortgage payment holiday is extended to Buy to Let mortgages.

The official Bill to enforce the new measures have not been released yet (from what I’m aware), so the finer details are unknown. I’m not looking forward to those.

However, my early thoughts…

On the surface these measures seem reasonable and useful. If you lean over and take a glance at the headlines, you may even feel inclined to applaud the government for being so uncharacteristically helpful.

Unfortunately, we are landlords, so we need to scratch beneath the surface and apply the measures in real case scenarios. Once you start doing that, you’d be forgiven for wondering if this pantomime is one big wind-up.

In practical terms, these measures seem like thoughtless knee-jerk counter-measures to appease anyone but landlords.

If these measures prove anything, it’s that there is still no such thing as a free lunch and we’re still being treated like fools.

Buyer beware.

Suspension of new evictions & possession proceedings

The press release implies that there is a blanket suspension of new evictions and possession proceedings for at least the next 3 months. There doesn’t seem to be any distinct mention of this policy only protecting tenants that are exclusively impacted by the coronavirus.

I am baffled.

So essentially, tenants can run around buck-wild for a minimum of three months with no immediate consequences, even if they commit acts of domestic misbehaviour, which includes damage to property, or fall into arrears for reasons totally unrelated to the coronavirus.

Basically, it looks like we’re on the verge of being shot in the ass with a tranquilliser dart. “Touch your toes for me, darling!”

But let’s be hopelessly optimistic and assume that this measure only applies to tenants that can prove they have fallen into rent arrears due to the coronavirus, and are therefore entitled to deferring their rent payments. Here’s the government’s strategy:

At the end of this period, landlords and tenants will be expected to work together to establish an affordable repayment plan, taking into account tenants’ individual circumstances.

This is bonkers, because the government seems to be flat-out playing dumb. This measure is irresponsible at best, and psychotic at worst.

Reality #1: the most vulnerable people in society will be impacted the hardest by financial turmoil. These poor souls live on the breadline and live pay cheque to pay cheque. There is no way even the best intentioned tenant will be able to repay “rent holidays” in any reasonable timeframe, and this has been proven over and over again when landlords have taken tenants to court for rent arrears.

The government must know this, and that is why they will NOT underwrite the temporary lines of credit they expect us to provide, or pay the rent on behalf of the tenant and then recover the money themselves.

Reality #2: assholes will take advantage of the rent holiday, and there’s no mention of any safety measures in place. I’m not expecting any either.

I’ve said it before and I’ll say it again: drug dealers are still dealing, and looters are still looting, and I’m sure there are scumbags out there diluting bottles of sanitizer with donkey piss to increase profit margins.

Do they think everyone in society has suddenly become an innocent victim?

Reality #3: while many tenants are self-isolating at home they will naturally consume more utility services (e.g. gas and electricity). Some landlords *include* utility bills with the rent, particularly HMO landlords, so their costs are likely to skyrocket, especially if the tenants are requiring rent holidays.

Much of this debt will inevitably be lost money and tax write-offs for landlords.

In the medium to long-term, this seems like it’s going to be extremely damaging for both landlords and tenants.

On a side note, some tenants have runaway with the idea that a “rent holiday” (deferred rental payment) is the same as a “free rent” period that doesn’t need to be repaid.

It’s not.

But many of them will be right.

BTL Mortgage Holidays

The ultimate wolf in sheep’s clothing, so it appears.

Recognising the additional pressures the virus may put on landlords, we have confirmed that the three month mortgage payment holiday announced yesterday will be extended to landlords whose tenants are experiencing financial difficulties due to coronavirus.

Where to start with this one?

Firstly, from what I understand, we can “apply” for a mortgage holiday, so it is not guaranteed even if you need it. I believe it will be down to the discretion of the lender. So WTF even is this then? What does it have to do with the government? I don’t get it. *stares blankly*

It looks like they’re just passing on a message from the lenders and taking credit for doing sweet F-all.

Secondly, notice how this measure has an explicit condition of being impacted by the coronavirus, while the suspension of new evictions & possession proceedings is based on unspecified conditions. That means landlords can only qualify for a mortgage holiday if their tenant has been financially impacted by the coronavirus, but tenants are protected from evictions for the next 3 months regardless of rhyme or reason. Seems fair.

Thirdly, this measure would have been much more balanced if it forced lenders to qualify landlords for mortgage holidays if tenants stop paying rent in the next 3 months. But, of course, it doesn’t.

Fourthly, what about the many landlords that have no mortgage and rely on the rental income as their salary? No provisions whatsoever.

Fifthly (sounds very odd), interest is still payable and it will build up over those deferred months, meaning you will owe more on the mortgage.

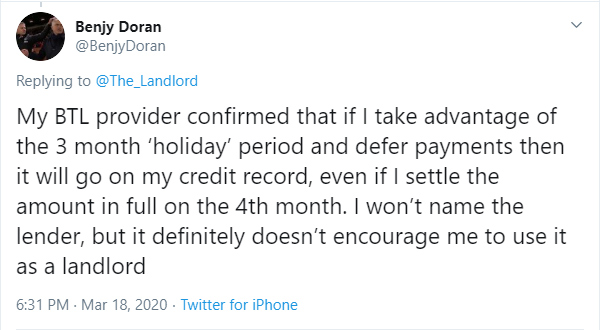

Lastly, and perhaps the biggest slap in the nuts of them all. If anyone takes ‘advantage’ of a mortgage holiday it may negatively impact their credit rating, which unsurprisingly, is a condition I haven’t read anywhere in the small-print. Here is a tweet I received yesterday:

I haven’t verified the legitimacy of this claim, but I have no reason to disbelieve.

If that is the case, the consequences of taking advantage of a mortgage holiday seems like too big of a price to pay, so I urge all landlords to discuss this matter with their lender first. If your lender says it will not impact your credit rating, please get it in writing. Even then, I’d still be dubious, personally.

Bear in mind, a poor credit rating could impact your ability to obtain future credit and your ability to remortgage onto better products. Being limited to poor mortgage products can be significantly expensive for borrowers for many years.

Ironically, both the NLA and RLA seem to be bragging that this move follows extensive lobbying by them.

Amazing job, thank you! I’ll put the ‘BTL mortgage holiday’ right next to my chocolate teapot!

This should be a last resort, if that. I’ll loiter the streets with my begging bowl before allowing my lender to have this one over me.

I never asked for or expected a handout, but…

I didn’t expect the government to help landlords in the first place. I think there’s too many hopeless hermits roaming the streets that have lost grip of reality. It’s quite concerning, to be honest.

People seem to be forgetting that we haven’t been able to efficiently fund the NHS, schools, and the police force, yet everyone, including politicians, is expecting handouts and bailouts to prop-up every industry and household on the planet.

I understand and accept that the government cannot help everyone right now, it’s simply unfeasible. But, my issue isn’t that, it’s that they’re trying to flog us a pile of steaming shit while packaging it as an act of mercy to “protect renters and landlords”

Unfortunately, I think these measures – in their current sparse form – are just pretty sparkly lights, and cheap attempts of misdirection. I’ll be utterly bewildered if they don’t end up being extremely costly for everyone, but the government.

The final details could be more reassuring, but I’m doubtful.

Bottom line, I wouldn’t rely on the government to support landlords during this crisis.

Nothing new to see here.

Other bits ‘n bobs!

- Keeping on top of the info – I’m trying my best to actively share as much information as I possibly can, and I’ll continue to do so, but everything feels like it’s moving far too quickly for my tiny hobbit feet to keep up with. I’ve been most active with updates on my Facebook Page, so I invite you to join it if you aren’t a member already.

Just as a reminder, I’m merely an inadequate and socially awkward blogger, so everything I share is based on my opinion, nothing else. I do, of course, try my utmost to keep you updated with accurate information, alas, my futile mind and resources are shamefully limited.

So, during these uncertain times, it wouldn’t be totally absurd to join a Landlord Association to get the most accurate information. I suspect as this ghastly situation continues to develop and unravel, more and more questions will need answering by landlords.

Many landlords are already asking questions that I simply don’t know the answers to (e.g. what if my tenant is isolating and I need to make essential repairs?). I’m not even sure if there are any guidelines for all the nuisances that will certainly pop-up because this is uncharted waters. But if there are answers available, a landlord association would be a good place to seek them.

I personally recommend Landlords Guild, but only because I find the head-honcho, Adrian, extremely personable, knowledgeable and approachable. Of course, the NRLA is also a very worthy option (despite their recent lobbying antics).

- Wills – Dear Heavenly Father, forgive me for this.

I feel terrible for even mentioning this, but it is the reality of what’s going on. I’ll keep it short, and I truly hope you understand!

I’ve noticed a giant uptick in Google searches related to wills, presumably by those that haven’t made any arrangements for how their assets will get distributed, if God forbid, the worst happens. I think people are starting to realise they’re not as invulnerable as they had once hoped.

Many of you will remember that I shared a positive review for an online will service called Beyond.life quite a while ago, after incurring a tragic… basketball injury, which… umm… left me with a dislocated finger.

Why do I feel like I’m going to burn in hell for this?

That blog post is now suddenly thriving with activity, and that can’t be a coincidence. Beyond.life allow you to quickly and easily create a professional will online in 15mins for £90.

I’m sorry. I’m done.

See you bog-roll bandits in hell.

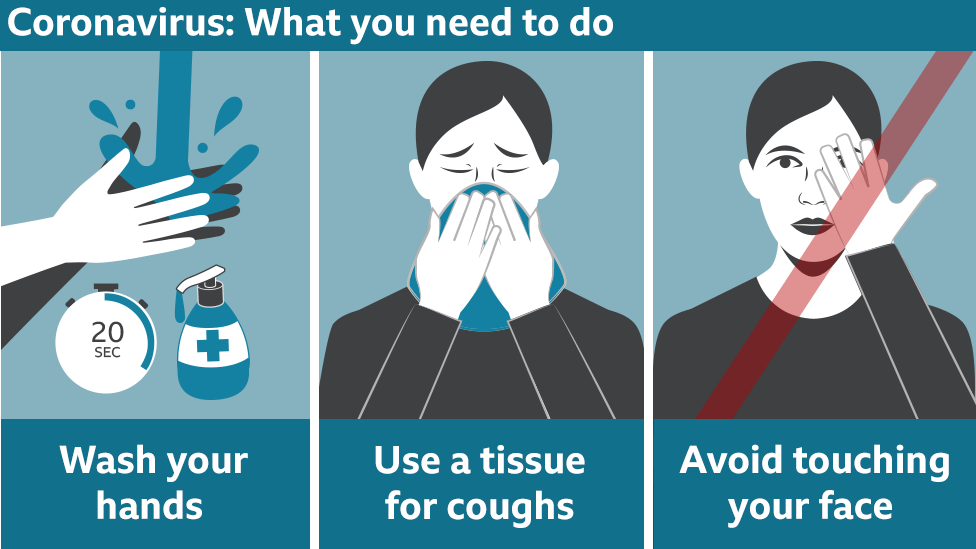

Stay safe and please continue to look after one another!

I want to reiterate my sentiments from my previous blog post, just in case anyone gets their knickers in a twist and misconstrues my gripes with these new measures.

I wholeheartedly hope every single landlord and tenant support one another through these difficult and uncertain times. Do whatever you can for one another.

I want the government and those in fortunate positions, to help the most vulnerable in society as much as possible.

Finally, sorry for being such a Debbie Downer. I know optimism may have been more beneficial right now, but I think it’s critical not to ignore the fact that we do have a future, and what we do TODAY will make a difference tomorrow. Life is not ending, despite popular belief.

P.s. can someone lend me some bog-roll, please?

Disclaimer: I'm just a landlord blogger; I'm 100% not qualified to give legal or financial advice. I'm a doofus. Any information I share is my unqualified opinion, and should never be construed as professional legal or financial advice. You should definitely get advice from a qualified professional for any legal or financial matters. For more information, please read my full disclaimer.

Landlord Products / Services

Landlord Products / Services

@Richard

I can sympathise with Paul Barrett regarding his potential loss of rental income.

My investments include property and I'm expecting to take a hit. My equity portfolio has certainly taken a hit. There's blood on the streets and some of it is my own.

But investing is about understanding and accepting risk.

Nobody forced Paul Barrett to invest in residential property. He could have invested all his money in U.S. Treasuries and right now he'd be laughing.

But with the amount of currency being created right now, I still think long term property will out perform US Treasuries and cash.

My situation is slightly different perhaps, in that my tenants also work for my family business. So it's in all our interests to be reasonable.