it’s the start of a new year, and we’re all about to lose our freaking minds and toss our inboxes out the window as they continue to get violated by the soul-destroying ‘Top property tips for [insert current year]’ newsletters.

*Vomit*

Thank you, Derek from the Wiltshire Property Times, but fuck no, I couldn’t care less about your speculative and quirky prediction that the civil parish of Crudwell will be a rental hotspot this year.

But my Lord, as a “blogger” slash “content creator”, I certainly do want a piece of the ‘This year you can stop sucking at property by doing this’ pie! That’s easy-pickings, especially for someone that’s bone dry on ideas. So here we are. my friends.

However, let’s not limit ourselves by focusing on this year or the next, or the speculative quirky guesses – because that would be utterly useless – but rather the long game!

Take it from someone that you shouldn’t be relying on for any useful information: too many landlords screw up by short-term thinking, and hoping for the best instead of planning for the worst.

Sure, there’s an optimum middle-ground somewhere, but most of us mere mortals lop to one side. If that’s the case, I’d personally rather be overly cautious and walk into a fart-wind in a hazmat suit, rather than trying to out-run it with my knobbly old knees.

Allow me to share my thoughts on how and why to focus on the bigger picture in order to help you succeed in property… year in, year out!

If you’ve been following me around on my socials recently, you’ll have noted that I’ve been ruffling the feathers of all the landlords droning on and on and on and on about “how it’s not worth being a landlord anymore, because of all the unfair regulations.”

I don’t disagree, landlords are being crucified by an onslaught of ludicrous and unfair regulations. It’s a fucking sick joke.

However, I’ve been hearing the same old shit for years. Haven’t you? We’ve been throwing our toys out of the pram over something-or-another since the dawn of mankind; HIPs, EPCs (and the minimum rating requirement), EICRs, Selective Licensing, Right-to-rent, to name only a small handful of reasons for our soiled pants.

Yes, this might be the worst it’s ever been for us because of the accumulative effect. But I’m not sure there’s ever been a time when we haven’t been prissy little cry babies.

Really, none of this feels any different from when my sweet old senile nan insists that “back in the day” the youth was far more civilized and respectful to their elders. And it certainly won’t be any different from when I scream the same drivel at my adolescent, snot-faced grandchildren (who will only come and visit to grab fivers out of my wallet while I’m having a catnap).

Can regulations get so tight to the point that it’s objectively not worth being a landlord for the vast majority? Sure, but I don’t believe today is that day.

Based on my own flimsy and anecdotal observations, many of the landlords making the biggest hoo-ha about change and the unrecoverable consequences, are the ones with the most to lose because they tried to outsmart the market by exposing themselves to too much risk. Essentially, their demise will be due to mistakes made on the fundamental level as opposed to anything else.

I’m sincerely not trying to kick anyone in the gonads while they’re on their knees gasping for air, this is just my terribly haphazard way of highlighting a problem (which doesn’t reflect the nuances of every case), hoping that it will provide food for thought to anyone that’s willing to munch on my crumbs.

None of the following is financial or investment advice, but rather, with the benefit of hindsight, this is what I’d be yelling at my younger self in order to avoid the doom many are (or soon could be) facing in the property sector…

Prepare for the long term

I know, what a horrifyingly cliché sentiment. Shall I also advise my younger bumfuzzled reflection not to put all his eggs into one basket? Useful.

I’ll elaborate to escape from being crowned Captain Obvious 2022.

Unless you plan on flipping, don’t think in months or a handful of years, think several years ahead and longer.

The property market is like every other investment cycle, it will eventually go through the natural highs and lows. The latter can include nuked economies and, of course, unforeseen suck-fest regulations that will rip you a new one.

We will rarely see the dark clouds approaching until it’s too late, which is why I’m a massive advocate of preparing for the inevitable shit flinging off the fan. I’ve found that the best way to do that is by:

- Slapping down lumpy deposits (30% at least, but more the better)

*BAM* HAVE IT! JUST TAKE MY DAMN CHEESE!

That way there’s a solid foundation filled with equity, ready and able to combat economic turbulence, particularly property crashes that lead to negative equity.

Many landlords will put down minimal deposits and insist that any more unnecessarily reduces liquidity and impedes growth (i.e. they would rather split their deposit and buy two properties, rather than putting more equity into one property). Fuck ’em!

The real degenerate gamblers among us got lured into property investment schemes that granted entry with little or no capital, and claim it’s easy money. Fuck ’em harder!

These are the same landlords that hurt and whimper the most during the storm, and wonder why they’re being victimised… and then go onto selling property courses to recoup their losses. “LOL”

- Having a contingency fund to deal with several months of rent arrears and maintenance.

I’m amazed at how many landlords don’t do this. It’s probably the number one reason why so many landlords get liquidated when they end up with a dud tenant that refuses to pay rent for months on end (which all landlords will deal with at some point).

- Avoid over-leveraging. If you’re straining yourself financially to buy a property and raise a contingency, then I’d recommend finding a cheaper property, or waiting until the cash reserves are in a healthier place.

I’d also avoid being haunted by the myth of having found ‘the deal of a lifetime’, one that’s too good to pass up.

You haven’t. And if you have, another will come along.

- Keep debt to a minimum, and build equity. I’m a raging fan of reducing debt as quickly as possible.

This ties into why I’ve recently been banging on about how the children’s party trick, rent-to-rent, sucks giant rhino balls. It does not work long-term in the real world because it does not build equity; it’s the literal practise of building a house of cards, which by definition, cannot tolerate any resistance (without a large cash reserve). Rent-to-rent landlords have dug their own graves.

Play stupid games, win stupid prizes.

Preparing for the long-term will help absorb all the inevitable and smaller headaches down the road, so that’s why it’s the best overarching advice I can offer any landlord.

I could hash together the same ol’ granular tips like, “Oh, make sure you have a written tenancy agreement, dumb-arse”, and while it’s practical advice, in the grand scheme of things, the real downfall of landlords stems from the foundational level, not the surface level bum fluff.

But seriously, make sure you have a written tenancy agreement, dumb-arse.

Consider the wider economic landscape

I’ll give you an example to set the scene:

I’ve seen a massive spike in landlords threatening to “sell up” due to new regulations (specifically Section 24, a ghastly little regulation massively increasing landlord tax liability [for those in large amounts of debt]), transforming their business model into a financially unviable turd.

Some will go further and say it’s not just about the money, they’re also fatigued from being the Governments sacrificial donkey.

I hear you loud and clear.

However, I wonder, how many of these landlords have considered the current state of the economy?

- Inflation: Governments around the world have been printing money like degenerate psychopaths during the pandemic.

So what does that mean? In layman’s terms, fiat currency (i.e. Government issued currency, for example, the Pound Sterling and the US Dollar) is losing its value, because the circulating supply has increased.

How do you know if your money is losing value? You’ll notice an increase in grocery and energy bills [while salaries often remain stagnant], A.k.a. the “rising cost of living”. That’s a la inflation.

In December 2021, the reported rate of inflation was 5.4% (the highest in 30 years). In other words, life got 5.4% more expensive. It’s probably much higher, though; Governments have a tendency to underplay the situation, and they do that by using a weak-arse formula to calculate inflation, which doesn’t reflect how bad it is for every day people (I know for a fact my shopping bill has increased MUCH more than 5.4%).

But anyways, let’s play dumb and pretend it’s 5.4% (it’s not), so that means any cash we held onto from the start of 2021 was worth 5.4% less by the end of it. Basically, that money has less buying-power (e.g. where £1 could purchase 10 used condoms last year, it can now only purchase 8).

Many speculate it will get worse before it gets better. I believe it.

- House prices: In 2021, the average house price in the UK increased by 10.2% according to Land Registry data.

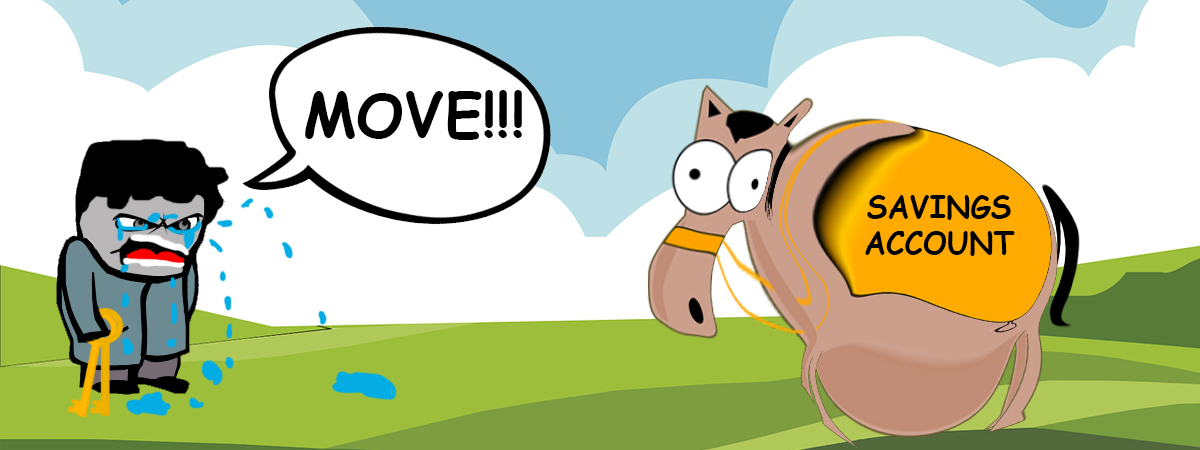

- Savings account: The best five-year fixed rate Savings Account on the MSE website currently offers a 2.1% return. I haven’t the foggiest who signs up for such lengthy fixed rates for such unappealing returns, but in any case, it’s still an obese donkey that isn’t outpacing inflation rates any time soon.

Do you see what I’m trying to say here? The Pound Sterling went down in value, while property went up significantly.

That means [the right] property is a much better store of value than cash right now, and it usually always is.

This is precisely why filthy rich people don’t hoard vast sums of fiat currency, they invest in vehicles like property and stocks to hedge against inflation. You’ve heard stories of millionaires’ snapping up properties like they’re collecting Pokemons, and blissfully leaving them vacant, right? Well now you know why they leave them vacant – even without the rental income (and the hassle of dealing with tenants) their money is working harder being locked in property compared to in a bank account, where its fate seems to be inevitable suffering.

That’s the reason why I’m putting more into property (and crypto, but I won’t get into that again!) right now despite all the gut-wrenching regulations, while others have decided to pull it out. I do wonder where all that money is going to get allocated once it’s extracted.

Yes, some of the regulations suck hard, but I’m not going to cut my nose off to spite my nozzle.

Just to reiterate, I’ve only covered a very simplistic example of how the wider economy matters.

In conclusion, I wouldn’t recommend focusing solely on monthly balance sheets when assessing the value of investing in property and determining how best your money can work for you.

Little me would still tell big me to “do one”, of course, because he thinks he’s the coolest cucumber in Cucumber town, and the impact of inflation is a tough cookie to conceptualise when you’re a gormless doofus that has absolutely no desire to understand how the economy could possibly mess with his patch.

Before jogging on, I need to toss in some caveats (so folk don’t shit the bed. Damage control!):

- I’m not in the business of telling anyone where to shove their hard earned money. My intention is only to illustrate why and how someone’s money might work harder for them invested in property, despite growing regulations.

- If any landlord is up to their tits in debt and/or dealing with unmanageable overheads, then all bets are off. The state of the economy and any looming regulations, whether they be fair or unfair, isn’t the issue (refer to my notes on long-term thinking).

- If anyone simply can’t be arsed anymore with the bureaucracy of being a landlord, then that’s a completely different story. I get it.

- If interest rates rise and the property market dips, then in the short-term tossing money into a high-yielding savings account *might* outperform investments such as property. However, in the long-term, property has always proven to be a safe bet (which again, perfectly highlights why thinking long-term is my way forward).

- Everyone’s circumstances are different, so it’s critical to note that I’m only making broad stroke assessments to illustrate how the wider economy can (and should) impact financial decisions. But more importantly, I’m not a financial advisor, so always do your own due diligence and seek advice from a qualified professional if required.

- I appreciate that property isn’t the only and easiest means of investing, so I’m sure a lot of landlords are pulling their money out and investing in other areas. I have no qualms with that.

I’m a big believer in being diversified. But I still believe investing in property is the best option (all things considered) ’cause it’s safe as HOW-ZEEZ.

Adapting to market shifts

Frequently assessing the environment and making subsequent changes, even if it feels scary, is usually prudent.

For example, when Section 24 was announced, it sent panic waves across the industry; I’ve never seen so many landlords keeling over, clenching onto their chest, and signalling difficulty in breathing.

Pussies.

When I first blogged about Section 24, I did disclose that I personally wasn’t particularly worried, because I’ve been limiting my risk and thinking long-term for ages (which, as said, caters for significant turbulence). However, even so, I did use some of my savings to make lump-sum payments to reduce the debt of my higher interest rate mortgages, to better manage the impact of the new taxation rules. It wasn’t necessarily a giant leap, but it was a pivot based on an environmental shift.

The comments section [in the blog post] was encouraging, because fellow landlords had responded with how they had also been proactive in light of the encroaching disaster.

Urgh, I’m sure I’ll regret this, because the regular contributor I’m about to throw under the spotlight can be the ultimate cocky little fanny-pack. But, credit where credit due – when I asked the crowd if and how they had made any preparations, his response and actions was a prime example of how landlords can and should adapt to swings:

Deleveraging, sold some [properties] and continuing to do so, putting up rents and building up reserves. I’ve sorted some of my mortgages onto 5 year fixes and kept the lifetime BofE +2% ers. I’ve now got out of DSS.

I’ve also got reserve plans of sweating the properties more but that would mean a lot more work.

– Benji (comment #44)

Clearly bold – and I’m sure difficult – steps were made, for the greater good.

Many of us deliberate for too long, and before we know it, we’re in a sinking ship, trying to scoop out the slush with a toothpick.

The market is never going to stop changing, so we either adapt or roll over. I recommend being a mover and shaker. Alternatively, sit on Landlord/Property forums all day squealing like a pig about it.

Download my free eBook for New & First-Time Landlords

My eBook… It hasn’t won or been nominated for any reputable or even dog-shit awards. It hasn’t been recognised by a single authority figure in the industry. There’s also a high probability it’s riddled with grammatical errors (I should probably get a proof-reader to do a once-over).

Have you noticed how EVERY Property/Landlord book author claims to be an Amazon best-seller? How does that even work? Anyways, I’m not one of them.

Fortunately, I’ve always been terrible at taking hints, and I’m still under the belief that my concoction is pretty OKAYish. You can download it here.

Aspiring, new or seasoned, I hope you make the best decision for your own individual circumstances and have a prosperous journey.

Big dog out xoxo

Disclaimer: I'm just a landlord blogger; I'm 100% not qualified to give legal or financial advice. I'm a doofus. Any information I share is my unqualified opinion, and should never be construed as professional legal or financial advice. You should definitely get advice from a qualified professional for any legal or financial matters. For more information, please read my full disclaimer.

Landlord Products / Services

Landlord Products / Services

In the last two years I have almost monthly letters wishing to buy my HMO,6 residents. I did not previous years. I guess because some think only HMO properties are profitable enough to be worth investing in now? Then there are the letters offering to manage it for me. Not interested and will not move and pay capital gains tax the only way to avoid is to go abroad for five years?