Unlucky 13. That’s certainly no coincidence.

One of the luxuries of having a website dedicated to a personal interest of mine, where people continually ask for advice and complain about shit, is that it allows me to gage where others go wrong. It’s a great tool to help avoid disaster.

While every landlord mostly has their own unique dilemma, when you whittle them down to the bones, they can usually get categorised into one of several common problems, many of which could have been prevented.

Here is a list of the biggest mistakes I read about, based on the comments left on this blog and various other landlord forums which I anonymously mooch around on…

1) “Forgetting” to secure deposits

Probably one of the hottest issues right now, and an issue I’ve talked about too much recently.

Many landlords still fail to secure their tenants deposit into a tenancy deposit scheme. Shocking because it’s basic shit. Real bread and butter stuff.

What many landlords fail to realise is that if the deposit isn’t secured within the allocated time of 30 days (from the moment the deposit is received), the tenant instantly gets a massive advantage. It’s like a scratch card win to them. They can prosecute the landlord for 3 x the deposit, and they become immune to Section 21 notices, which effectively means the landlord cannot regain possession without jumping through a lot of high and potentially expensive hoops!

Also note, it is the landlords responsibility to ensure the deposit is secured (even if you’re using a letting agent).

Update: as well as securing the deposit, landlords now also need to provide tenants with Prescribed Information regarding the deposit! Click on the link for more info.

2) Failing to use regulated letting agent

I’m not sure how or why it’s legal, but there are letting agents that operate without being a member of The Property Ombudsman (TPO). EVERY reputable letting agent is a member, because it means they’re willing to adhere to a strict code of conduct, which effectively increases consumer protection. If an agent isn’t a member, something is very wrong. I suspect they either got deregistered for ill-practices or subscribe to unusual activities so cannot become a member.

Every landlord that funds these unregulated agents is most likely feeding the bellies of very unsavoury characters.

Don’t use an agent that isn’t a member of a regulated body.

3) Skimming the letting agent contract

Everyone hates reading contracts, but unfortunately, in this industry it’s a necessary evil. Every mofo in this industry is yearning to squeeze an extra penny out of the next person, especially letting agents, and those pennies are usually extracted by taking advantage of negligence.

If you’re using a letting agent’s service, it’s important to read and understand every term in the agreement. They’re often riddled with penalties and fees, most of which are pretty sinister.

A common problem I seem to always stumble upon is landlords getting stung with unexpected tenancy renewal fees. The fee in principle is bullshit, but it’s legal as long as it’s clearly stipulated in the contract. So if you’re unexpectedly stung by it, you probably made the gross error of failing to read the contract properly. Oops.

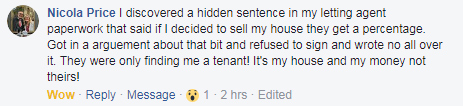

I was blown away when someone informed me about the following clause they found crammed into their contract:

Ridiculous.

I’m assuming the agent gets a percentage if the landlord sells the property while it’s tenanted, which is just insane.

But the reality is, people are signing that crap.

4) Providing new tenants with long-term contracts

I never understand why landlords offer new tenants with long-term contracts! It doesn’t make sense to me because short-term contracts best serve both parties, tenants and landlords.

My rule of thumb is to never give new tenants a contract longer than 6 months, regardless of how mouth-watering their credentials are. Simply, you never know how good or bad a tenant will be until they’re actually your tenant. References are useful and good, but they don’t guarantee anything.

Knowing you have a tenant tied into a 12+ month contract can make for a beautiful feeling; you assume you don’t have to go through the painful and mundane task of trying to find new tenants anytime soon.

But actually, offering a 6 month contract can be safer, and the positives for “initially” providing a short-term contract far outweigh the positives for a long-term contract, as I discuss in-depth in another post on how long a tenancy agreement should be.

You can find out a lot about a tenant in the first 6 months, especially based on property inspections and their rent payment history. If after 6 months both landlord and tenant are happy with the arrangement, there is absolutely no reason why a long-term contract can’t be arranged. However, if problems occur within the 6 months, both parties are effectively tied in for a whole year. And remember, it’s a lot easier for a landlord to repossess their property at the end of a fixed term than evict their tenants halfway through a tenancy.

The idea is to test the water first, and then consider committing. [insert joke about women and marriage]

In conclusion, landlords that offer long-term contracts to strangers are opening themselves up for long, drawn out affairs if things go wrong, which in this climate, it frequently does.

5) Skipping property inventories

Since the introduction of the tenancy deposit scheme, property inventories have been crucial for landlords, yet it still doesn’t seem to be high up on the pecking order. Why is it crucial? Because no longer is the tenant’s deposit in the fate of the landlord, it’s now in the fate of an impartial adjudicator, who will assess the situation by the evidence that he or she is provided with.

God forbid if a tenant causes destruction to the property and refuses to take responsibility, the landlord will have to prove to the adjudicator, appointed by the deposit scheme, that the property was never given to the tenant in the condition he/she has left it in. Without an inventory, it’s extremely difficult to do that.

Inventories don’t take long, and they don’t have to cost anything more than a limited amount of time, so excuses are difficult to find.

6) Skipping Property inspections

The point of an inspection is to find out how well or poorly a tenant is treating a landlord’s property. If a landlord is investing £100k+ into a property, why wouldn’t they take 20 minutes out of their day, once every 3 months, to find out what condition their investment is in? Seems like very little work.

I’m pretty sure if every landlord did regular inspections they could identify problems earlier than they actually do and nip them in the bud before they spiral out of control.

7) Too lazy to do research

Research is key, but people still love to opt for convenience over value. No wonder chronic heart failure is escalating.

Don’t use a letting agent just because they’re positioned 10 meters from your front door. In this competitive market there’s always someone offering a better service at a better rate, so search for it. Don’t use any service without typing their name into Google. Believe me, if they’re notorious for offering poor service, odds are, someone will be having a hissy-fit about it on a forum somewhere.

Whatever you do, whoever you plan on using… research. It’s the key.

8) Purely relying on short-term market growth

This is a personal gripe of mine; when novice landlords invest for the short-term and rely on market growth to make a quick 20k. Then, when it inevitably doesn’t happen, they play the victim while drowning in negative equity because they took out a heart-stopping mortgage, with the initial intention of jumping out of the game before feeling the full-force of the repayments.

I’m not saying it’s not possible to make money in the short-term, I’m just saying that no novice landlord should enter the market relying on rapid rates of inflation. Strap in for the long-term.

The dying days of the mid 2000 property boom gave a lot of landlords insight to a false economy. But the success stories are still floating around, and people still believe it’s a quick in-and-out affair. It’s not.

In this climate, buy-to-let is a long-term strategy, and market growth won’t happen overnight unless there’s a sudden boom. And I don’t see that happening for a long time.

9) Harassing tenants

I genuinely hate the whole landlord harassment law. It’s so jacked up because it provides “rogue” tenants with rights they don’t deserve. If a tenant is 2 months in arrears, as a landlord, I should be able to knock on their door and/or call/text them constantly frequently, insisting that they pay the rent. That should not be classed as harassment; not in my book anyways. But according to the less awesome book, the one that matters, it can be.

This is what the law stipulates, Protection from Eviction Act 1977:

The landlord of a residential occupier or an agent of the landlord shall be guilty of an offence if –

(a) he does acts likely to interfere with the peace or comfort of the residential occupier or members of his household, or

(b) he persistently withdraws or withholds services reasonably required for the occupation of the premises in question as a residence,

and (in either case) he knows, or has reasonable cause to believe, that that conduct is likely to cause the residential occupier to give up the occupation of the whole or part of the premises or to refrain from exercising any right or pursuing any remedy in respect of the whole or part of the premises

The important bit is in bold, “has reasonable cause to believe, that that conduct is likely to cause the residential occupier to give up the occupation”

If you constantly hound a tenant for arrears (which I believe is reasonable conduct given the circumstances- but isn’t), the tenant could argue that you’re forcing them to surrender their occupation. If that’s the case, it can be classed as harassment. That never made sense to me, because given the circumstances, why wouldn’t I want to try and get the tenant to leave? Seems like the logical step.

In any case, one of the biggest mistakes made by landlords is that they don’t understand, or perhaps choose not to acknowledge, what constitutes “harassment”. The actual definition is sickening, and I don’t blame any landlord for burying their head in the sand. The reality of it makes me want to blow my brains out, but it is what it is…a pile of steaming shit.

10) Accepting DSS tenants without knowing what they are

Guilty. I did this once.

My first ever tenant was a DSS tenant, and I had no idea what it meant; I didn’t care to find out at the time either. All I remember is that my letting agent told me it was guaranteed rent because the Government paid it direct to the landlord (which was the case at the time), but the agent conveniently failed to inform me of the following:

- 1) The tenant’s benefit allowance can change at any time, literally with a click of a finger e.g. the powers that be can reduce or even completely cut off their allowance. So in reality, the rent isn’t guaranteed- there’s no such thing. This actually happened to a tenant of mine, and I was left helpless. One minute I was receiving their allowance, the next I wasn’t.

- 2) DSS tenants typically have a short-fall to pay each month. This means that if a tenant’s benefit allowance doesn’t quite cover the entire month’s rent, they have to pay the short-fall. This effectively means the landlord has to collect 2 separate rent payments per month, for the same tenant. It can get annoying, and it becomes more apparent that the entire rent isn’t guaranteed.

- 3) Payments are made every 30 days, which is extremely impractical and confusing for the landlord because we typically charge rent on a PCM basis.

- 4) DSS tenants struggle to find landlords that accept them, so I didn’t need to pay my agent £800 to find me one. I could have put a free listing up on Gumtree and found the exact same product. At the time I didn’t realise how tough they had it.

Someone else recently left a comment on my blog, saying they felt they were pressured into accepting a DSS tenant by their agent. It’s not hard to believe that landlords, especially new ones, are often encouraged by agents to accept DSS tenants without actually educating them first on the subject. One could argue it’s not the agents duty to educate. However, they often do paint a pretty picture, by using magic words like “guaranteed rent”, “government funded”, and all these wonderfully reassuring words.

But don’t be fooled, it actually means shit. It’s just smoke and mirrors.

I’m not saying landlords shouldn’t accept DSS tenants, I’m simply saying that a common mistake is that landlords accept DSS tenants without actually understanding what the implications are.

11) Allowing rent arrears to escalate

This one astounds me the most. The amount of times I read the following is scary, “My tenant is currently 8 months in arrears, what should I do?”

What the hell? What kind of shit-for-brains allows a tenant to fall 8 months in arrears before taking action? It’s crazy! From the moment a tenant is approaching 2 months in arrears, the landlord should be seeking legal advice from tenant eviction specialists (if they need it), and start planning the process of serving notices.

Why do landlords wait around? What are they waiting around for? The biggest trap landlords fall into is believing that the tenant will resolve their arrears. It almost never happens, regardless of how reassuring the tenants are. And if it does, the notices that were served can be terminated/ignored.

12) Disregarding the requirement of a Guarantor

Putting a Tenant Guarantor in place costs nothing, and it provides landlords with an extra layer of reassurance and security. It’s a no-brainer, yet some people don’t seem to bother with it.

In many cases, tenants claim that they can’t get a Guarantor. In that case, I don’t even consider them as prospective tenants. I ensure that my advert(s) clearly specify that a Guarantor is a prerequisite.

I find that a Guarantor doesn’t only give the landlord an extra avenue to pursue costs for damages and rent arrears, but it also gives the landlord a psychological edge. Most Guarantor’s are either close friends or family members of the tenant, so the last thing the tenant will want is for the landlord to be knocking on their door chasing money. The potential shame and embarrassment of it all usually provides the tenant with extra incentive to pay the damages, and go that extra length to source the funds, if required.

13) Allowing tenants to develop bad habits

The thing with tenants is that they’re like dogs; if you let them piss on your carpet once, they’ll just carry on doing it.

It’s crucial to nip any early signs of danger in the butt immediately. Be firm if you have to.

One of the most common scenarios is when landlords remain silent when their tenant pays their rent late. Don’t get me wrong, in most cases it’s not a big deal, and it shouldn’t be cause for concern. However, when it happens the first time, as a landlord you should make it clear that you expect it to be on time the next time, so the tenant is aware that it’s not acceptable, and they can’t get away with it going forward.

Well, that’s my list. Anyone got anything else to add? Please share! x

Disclaimer: I'm just a landlord blogger; I'm 100% not qualified to give legal or financial advice. I'm a doofus. Any information I share is my unqualified opinion, and should never be construed as professional legal or financial advice. You should definitely get advice from a qualified professional for any legal or financial matters. For more information, please read my full disclaimer.

Landlord Products / Services

Landlord Products / Services

I would be interested to know whether you would have accepted the following tenant:-

1) The Tenant moved from abroad, so his official credit score was back to zero again

2) The Tenant has their own business, but had to have a top up from tax credits and housing benefit

3) The Tenant therefore could not get a reference from an employer, being self employed

4) The Tenant did not wish to use a family member (the only one being eligible but elderly) as a guarantor

5) The only thing that the Tenant could offer was to take a 6 month contract and pay 3 and a half months, as a security deposit instead of one and a half, as well as the month in advance in full.

Judging by the fact that most people renting these days are entitled to some form of top up by a means-tested benefit (High earners would have bought their own home ages ago) I wonder how you would have judged this tenant?

The tenant has now been living in the property for 10 months, the rent is paid not only on the due date, but often several days in advance and the property is always spotless! However, because this tenant could not provide any of the required references, you would have dismissed him, missing out on the perfect tenant, and probably taken somebody on who could provide all the references but who was made redundant shortly afterwards or trashed the property beyond repair!